Symbiotic Vaults Overview

Symbiotic is a restaking ecosystem and shared security protocol designed to create a marketplace for economic security. It enables networks that need security to access it from those with assets to stake, creating an ecosystem where stake can be shared and utilized across multiple networks, a process known as “restaking.”

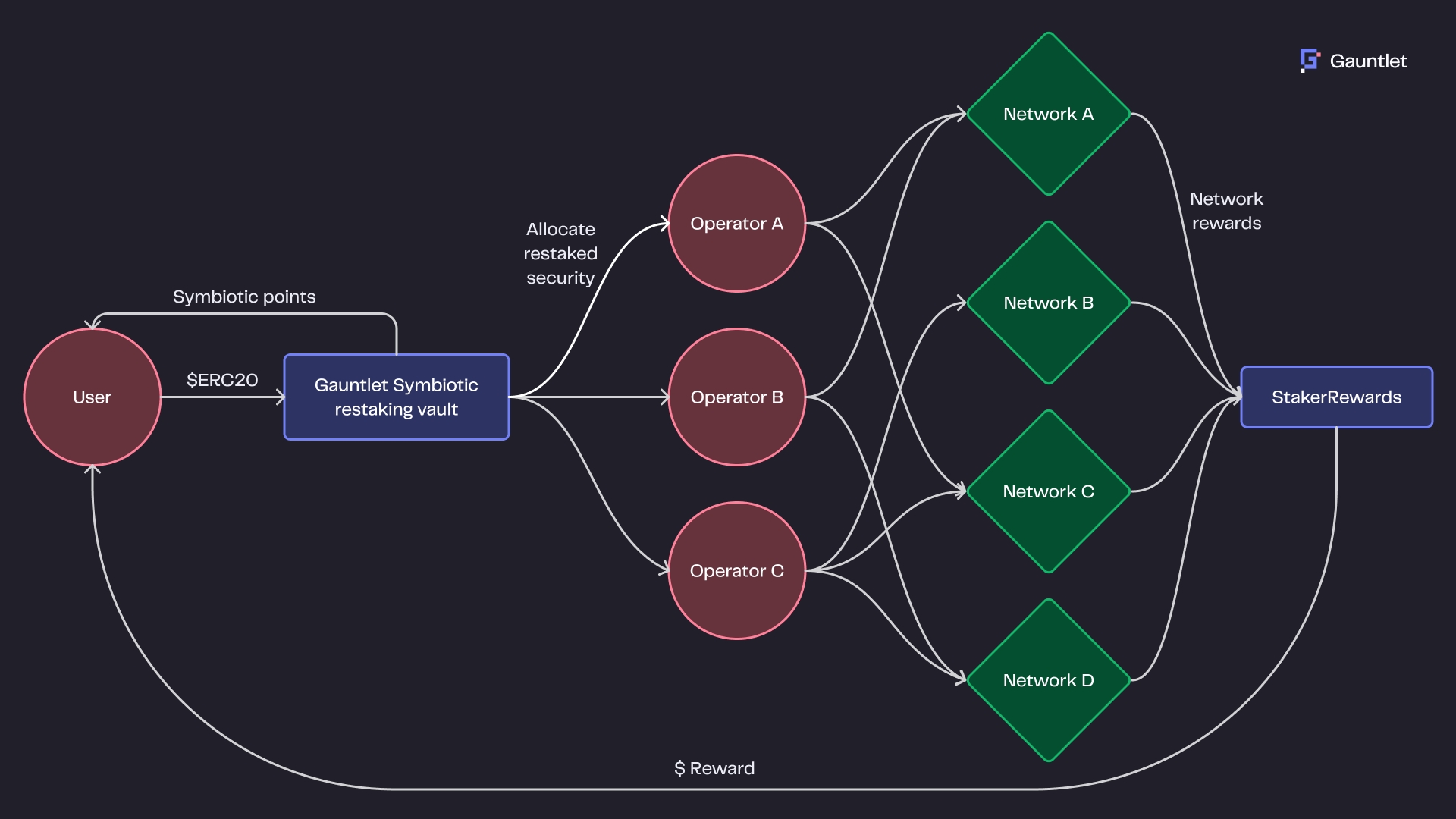

Symbiotic Restaking Vault Structure

Vaults serve as a flexible staking layer connecting collateral to networks. Users can deposit their collateral into vaults and benefit from staker and network rewards in the form of risk-adjusted yield. Curators like Gauntlet decide where to allocate that collateral (shared security) and can tailor the risk profile of each vault by determining which networks and operators have access to the collateral.

The main pillars of a Restaking Vault include:

Collateral asset (ERC20) — users supply this asset into the vault

Operators — the vault allocates to a set number of operators

Networks — operators allocate to networks predetermined by the vault curator

Two important actors play a central role in Restaking: operators and networks, where operators can allocate across N networks. Vaults allow curators to manage the economic risks that arise from allocating across various operators. The matrix of allocations across and between operators and networks is the variable that defines the different risk profiles on Symbiotic Restaking Vaults.

Was this helpful?