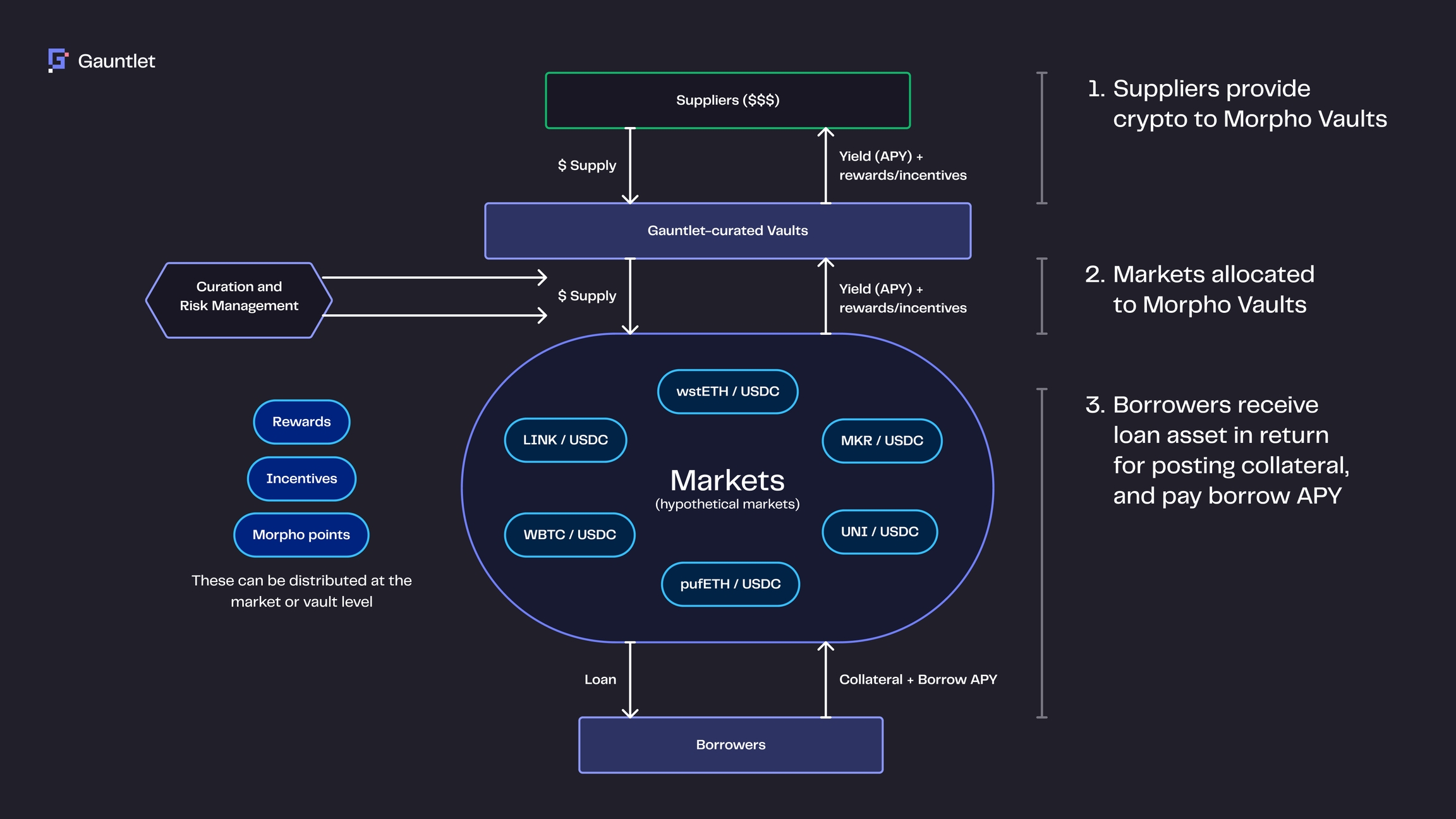

Morpho Vault Structure

Supply Asset

The supply asset is the foundation for a vault. To access Gauntlet-curated vaults and the associated risk-adjusted yield, a supplier must add supply to the vault.

Vault APY

Annual percentage yield, APY, is the main economic draw of Morpho vaults. It represents the annualized return suppliers receive as a percentage of the assets supplied to a vault. APY is determined by the markets to which a specific vault allocates its supply, as well as any incentives in those markets. APYs change dynamically based on several parameters, including market utilization and supply allocation.

Allocated Markets

A vault’s supply APY results from the underlying lending markets to which it allocates.

Suppliers

Suppliers are the primary users of Morpho Vaults. They supply a particular asset into a Vault, which generates risk-adjusted yield based on the vault curator’s market allocations. Selecting an appropriate set of markets to supply loan assets against can be a complex task, requiring a nuanced understanding of risk management, market dynamics, and yield optimization. Gauntlet vaults on Morpho simplify this process, with experienced vault curators like Gauntlet executing strategies on their behalf in a non-custodial manner.

Last updated

Was this helpful?