Market Utilization

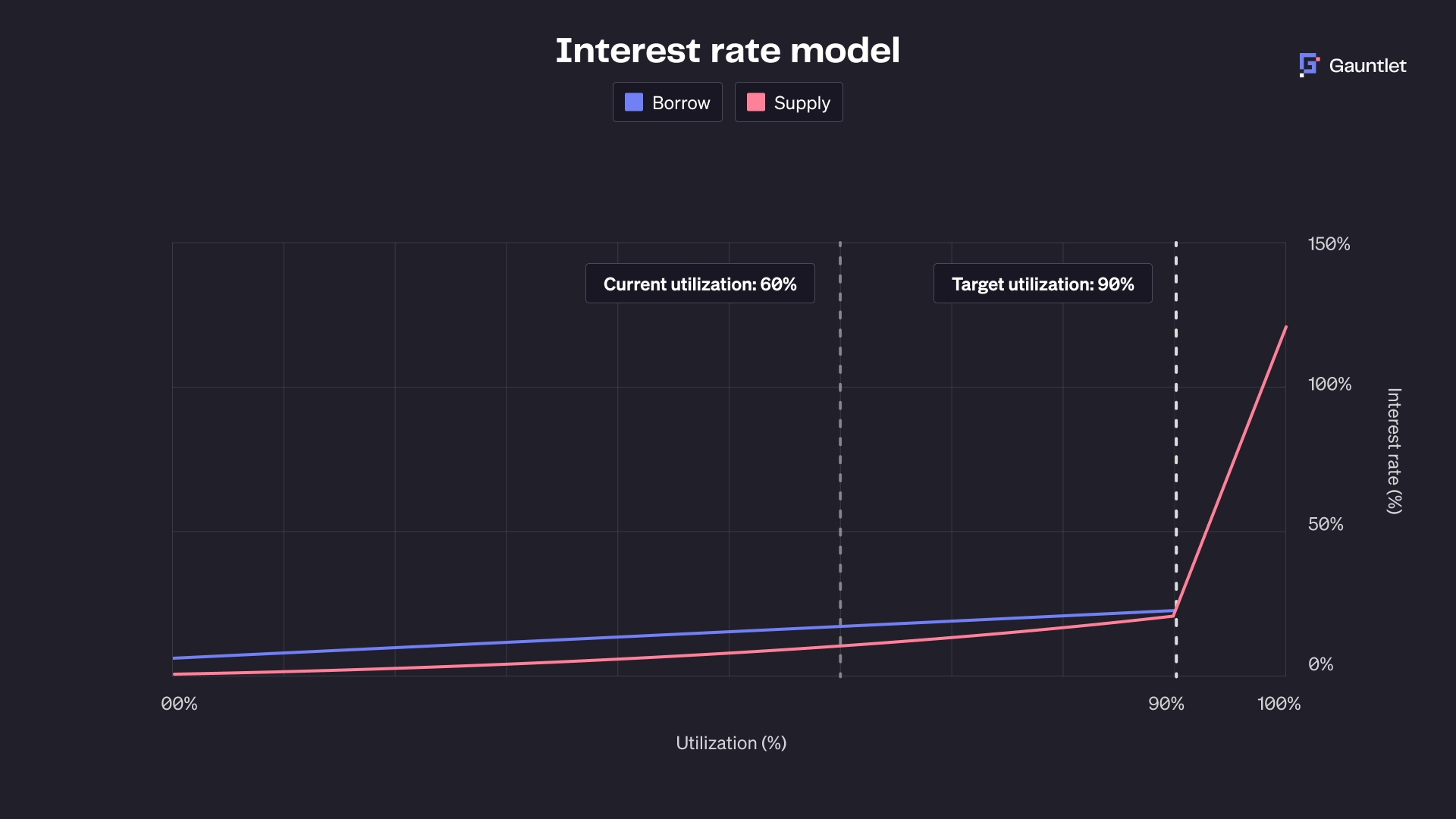

Utilization of any allocated market should not exceed 90% for an extended period of time (>48 hours). Beyond this optimal utilization point, both borrow and supply APYs increase rapidly, which, while beneficial for suppliers in the short term, compels borrowers to unwind positions, reducing long-term yield.

Was this helpful?