hJLP 2x

Visit the vault.

Strategy Overview

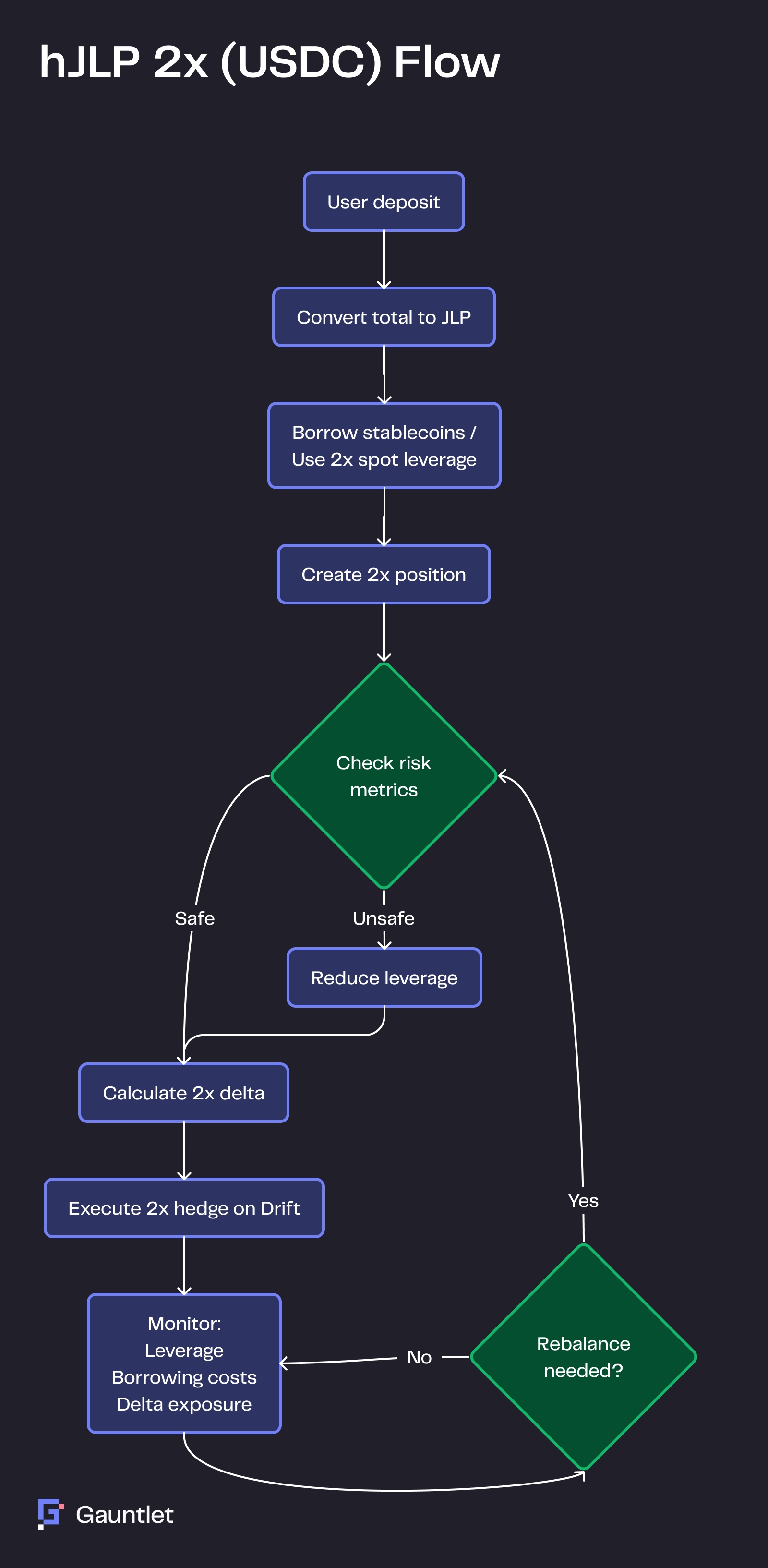

Hedged JLP 2x is a strategy that provides double exposure to JLP yields while maintaining delta neutrality through strategic short positions on Drift Protocol. The strategy targets up to 2x leverage to amplify JLP yields, borrowing stablecoins on Drift's lending market (also called spot margin) to achieve this enhanced exposure. Through sophisticated position management and continuous monitoring, the strategy aims to maximize returns while carefully managing the associated risks of leveraged positions.

Core Mechanics

The strategy achieves 2x exposure through a carefully balanced combination of techniques. When users deposit funds, the strategy leverages these deposits to create a 2x position in the JLP pool. The leveraged position is then delta-hedged through corresponding short positions in the underlying assets (SOL, ETH, BTC) on Drift Protocol. This process involves taking user supply in USDC, borrowing additional stablecoins to double the position size, converting the total capital into JLP tokens, and establishing corresponding hedge positions on Drift.

The borrowed stablecoins necessary for leverage incur ongoing interest charges that impact the strategy's net returns. These costs are actively monitored and factored into position management decisions, with the strategy continuously optimizing between leverage levels and borrowing costs to maintain optimal performance.

Delta Hedging Implementation

The maintenance of delta-neutral positioning forms a crucial component of the strategy's risk management approach. The total hedge size is calculated as the product of asset exposure and the leverage factor, with the strategy targeting a delta near zero within acceptable deviation bounds (up to 5%). Position rebalancing occurs through a system that considers multiple factors, including delta exposure thresholds, regular time-based intervals, and market volatility events.

Risk Management and Monitoring

The strategy employs comprehensive risk management systems that continuously monitor multiple aspects of position health. These systems track leverage ratios against safety thresholds, assess borrowing costs and their impact on returns, monitor delta exposure across all assets, and evaluate liquidation risk parameters. The availability of sufficient liquidity for hedging operations is constantly evaluated to ensure smooth strategy execution.

Liquidation prevention represents a critical aspect of risk management. The strategy implements a multi-layered approach to protection, combining conservative leverage limits with automated deleveraging triggers.

Market and Technical Risk Considerations

The doubled leverage integral to the strategy amplifies both potential returns and losses. Market risks manifest primarily through price volatility in underlying assets, which can trigger larger position swings due to the leverage employed. While delta hedging helps mitigate directional exposure, extreme market movements can still impact strategy performance through increased rebalancing costs, high borrow interest, and potential liquidation scenarios.

From a technical perspective, the strategy faces smart contract risks despite thorough third-party audits. The reliance on multiple protocols (Jupiter, Drift) compounds smart contract risk from these dependencies. Position management confronts several operational challenges, including data feed reliability for accurate hedging, execution latency during high volatility periods, liquidity constraints on Drift affecting hedge placement, and interest rate fluctuations impacting borrowing costs.

Architecture and Implementation

The strategy operates through non-custodial smart contracts that maintain user custody of funds through private key control. While contract upgrades and parameter changes remain possible, the system's core architecture ensures users retain ultimate control over their assets. Position management occurs through an automated system that handles real-time monitoring of leverage and exposure, rebalancing of hedge positions, adjustment of borrowing positions, and optimization of gas costs.

Last updated

Was this helpful?