User Flow

1. Accessing Gauntlet Vaults

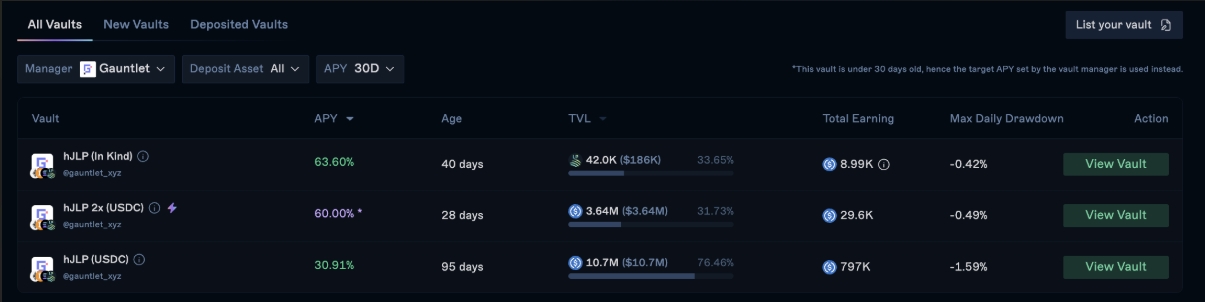

• Navigate to the vaults page (https://app.drift.trade/vaults), where you’ll see a list of vaults showing APY, Age, TVL, and more.

Protip: filter on 'Gauntlet' as manager to only see vaults curated by Gauntlet

• Select a vault by clicking “View Vault” for details on performance, capacity, and strategy.

2. Depositing Funds

• On the vault’s page, enter the amount you wish to deposit.

• Click “Confirm Deposit,” then approve the transaction in your connected wallet. Once confirmed, your share balance will be updated.

• Deposited funds typically have a redemption lock period (e.g., 3 days) before withdrawal is possible.

Note: because of slippage incurred while entering the strategy, your vault will initially show a negative return immediately following deposit; this is expected.

3. Tracking Performance

• Vault Performance Tab: shows APY (7D/30D/90D), TVL, and metrics like Max Daily Drawdown. Track total earnings and ROI in real-time.

• Your Performance Tab: displays Current Balance, Total Earnings (All-Time), and ROI, along with a chart showing earnings, fees, and high-water marks over time.

• Overview Tab: Summarizes the vault’s strategy, risk profile, and relevant disclosures.

4. Withdrawing Funds

• Click “Withdraw” on the vault’s page and specify the amount (up to your vault balance).

• Withdrawals enter a redemption queue (e.g., 3 days). After this period, finalize the withdrawal to receive funds in your wallet. Any unclaimed amounts will be held in USDC.

• Note that share value changes (due to negative PnL or JLP premium) as well as performance fees collected may cause the final withdrawal amount to be lower than the initial request. Funds in the queue will not accrue further profits.

5. Managing Your Vault Position

• Deposit More: You can add more funds anytime, subject to the vault’s capacity. Note that because the vault collects performance fees whenever a user interacts with the vault, new deposits may trigger a fee if the current vault balance is above the high watermark.

• Compound Earnings: Gains are typically reinvested automatically.

• Monitor Regularly: Check performance, funding rates, and protocol updates to ensure the strategy aligns with your risk tolerance.

Was this helpful?