Our Approach to Drift Strategies

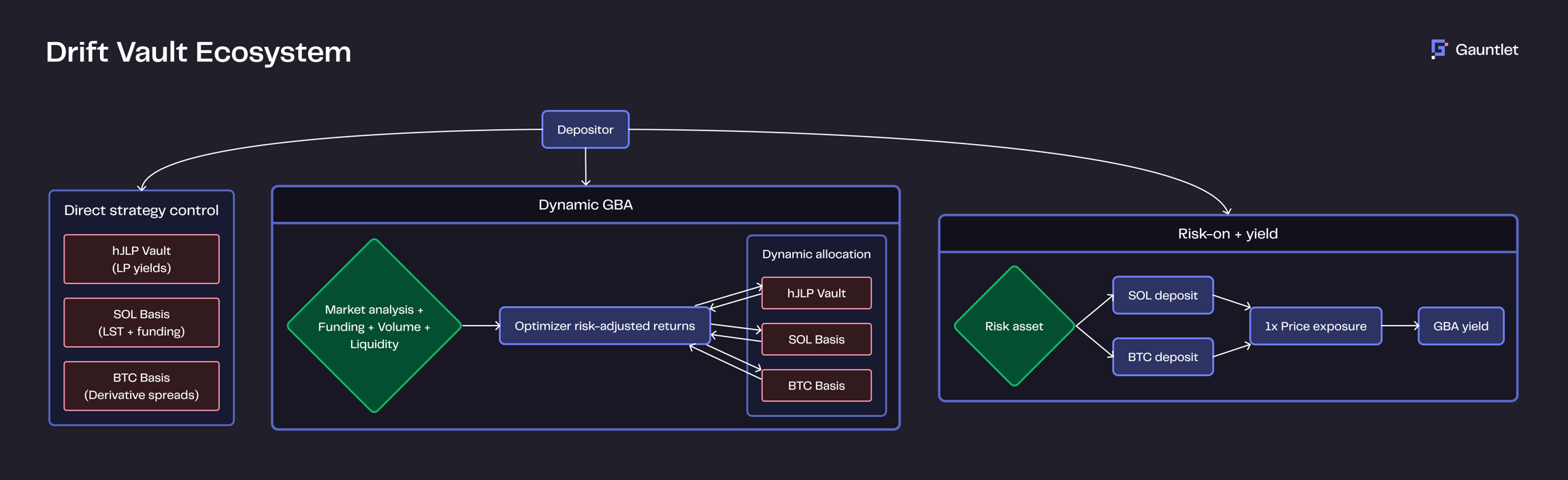

Individual strategy vaults like hJLP form the foundational layer of our vault curation on Drift. These strategies are designed to mitigate risks associated with providing liquidity to Jupiter's perpetual exchange while maintaining attractive returns.

The Gauntlet Basis Alpha (GBA) strategy implements a portfolio view across all basis trades. Starting with allocations to hJLP, SOL LST, and BTC Basis Trades, it will continuously and autonomously rebalance based on real-time market conditions, considering funding rates, liquidity conditions, trading volumes, and historical performance patterns. This removes the need for active management while maintaining sophisticated optimization. New assets may be added in the future, see here for current allocations.

The Beta + GBA Overlay strategies maintain exposure while still capturing basis yields. By supplying SOL or BTC as collateral to borrow stables for GBA deployment, these vaults can earn incremental yield on supplied digital assets.

Together, they create a comprehensive approach to yield generation that adapts to different vault user preferences while maintaining consistent risk management standards.

Last updated

Was this helpful?