hJLP (In Kind)

Visit the vault.

Overview

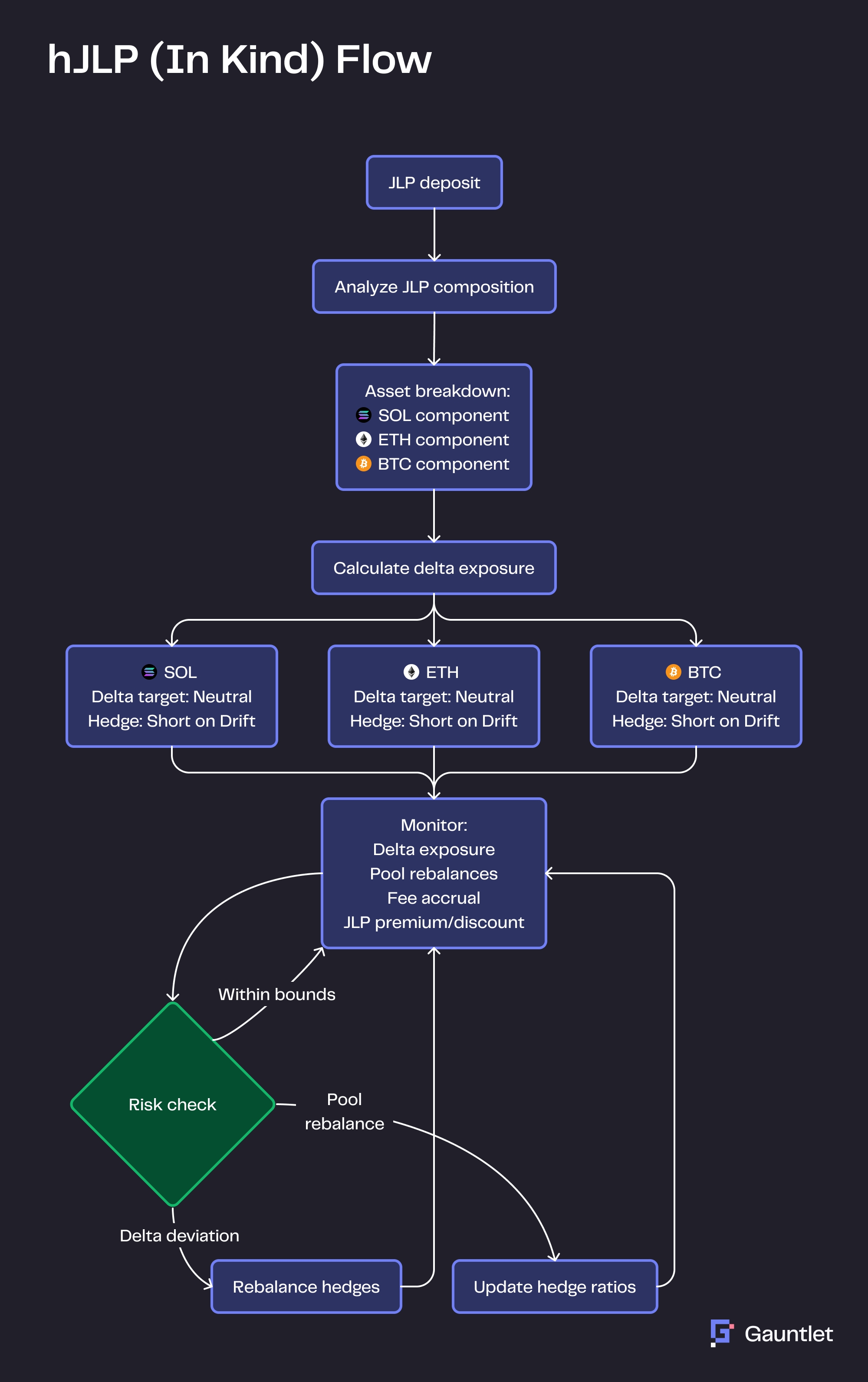

The In Kind JLP vault enables direct JLP token deposits while implementing hedging to protect against price movements of the JLP basket assets. Users maintain exposure to Jupiter's liquidity provision fees while neutralizing underlying price risks without needing to convert their tokens to USDC first.

How It Works

Similar to the 1x hJLP (USDC) vault, this strategy creates matching short positions on Drift protocol to offset price exposure. Revenue comes from two main sources:

Jupiter trading fees proportional to JLP share

Funding rate yield from Drift short positions

Key Benefits

This vault seeks to preserve the USD value of the principal, deposited in JLP tokens, while accruing fee revenue from providing liquidity to the Jupiter Perpetuals market. JLP holders do not need to trade out of their asset into USDC to use this vault, thereby saving on slippage and transaction costs.

Withdrawals

Users receive JLP tokens on withdrawal. Because the strategy hedges price risk in USD terms, the token quantity may vary from deposit.

Was this helpful?