hJLP

Visit the vault.

Overview

The hJLP (Hedged Jupiter Liquidity Provider) strategy is designed to mitigate risks associated with providing liquidity to Jupiter's perpetual exchange while maintaining attractive returns. This documentation provides a comprehensive overview of the implementation details, data processing mechanisms, hedging approaches, and execution management systems that power the strategy.

Hedging Venue: Drift Protocol

Drift Protocol serves as the primary hedging venue for the hJLP strategy. The protocol maintains deep liquidity pools that enable large hedging transactions with minimal slippage. Its cross-margining capabilities allow for efficient capital utilization across multiple trading pairs, allowing the strategy to deposit JLP in the pool and create perpetual positions in multiple assets using the same collateral (JLP in this case). The transparent nature of the on-chain orderbook significantly reduces counterparty risk and enhances overall strategy security.

Strategy Implementation

Core Flow

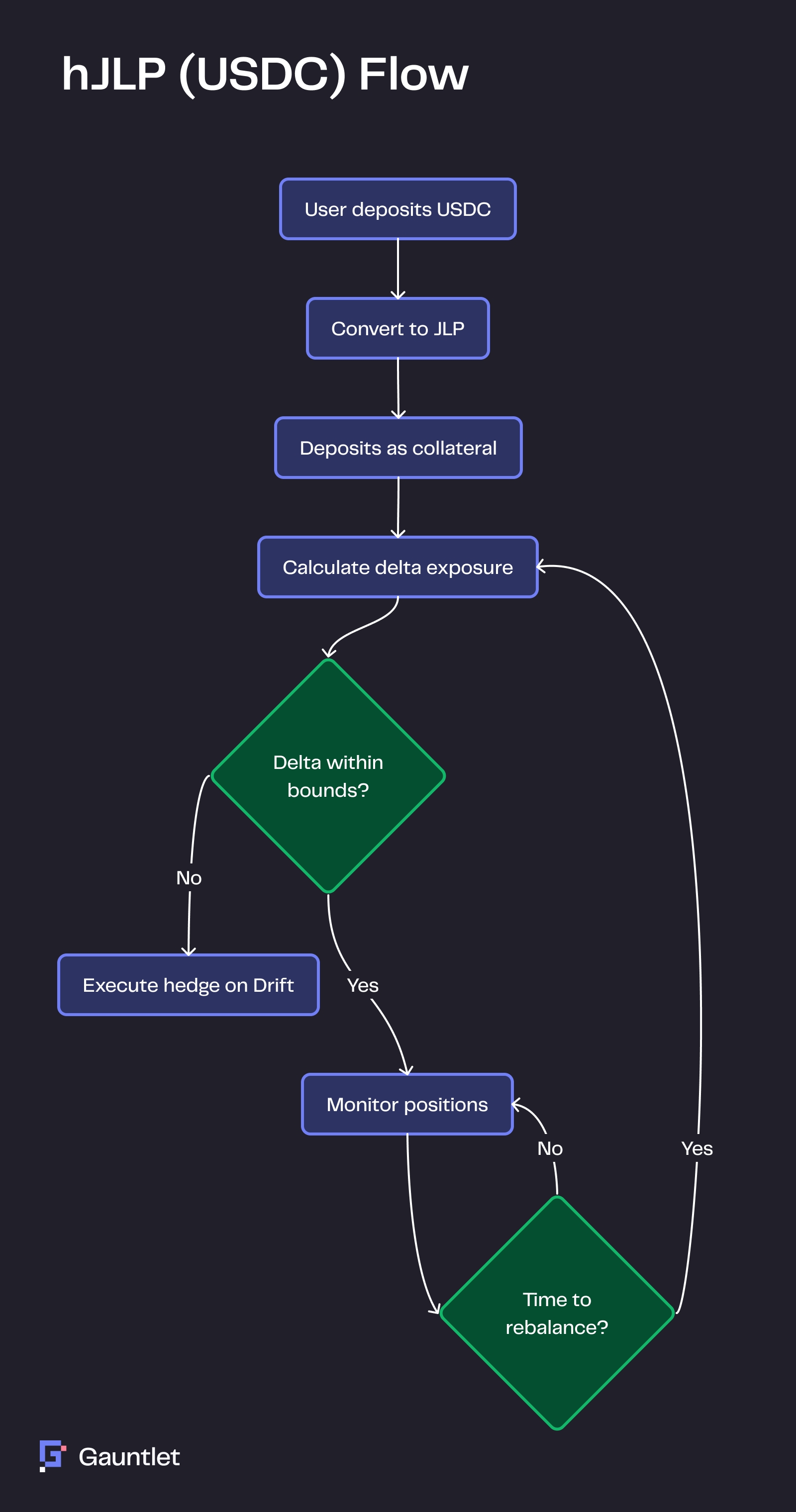

The strategy implementation follows a process that begins when users deposit supported assets into the hJLP vault. These assets are automatically converted to JLP tokens through Jupiter's DEX, ensuring all user deposits are in the required token for the hedging strategy. The newly acquired JLP tokens are then deposited into Drift as collateral, enabling the opening of initial hedge positions based on current delta exposure in the JLP pool. The system maintains these positions through dynamic rebalancing, triggered either by predetermined time intervals or when positions deviate from target thresholds.

Integration Architecture

The strategy leverages Drift's vault infrastructure, which provides battle-tested security for user deposits and efficiently handles large volumes of deposits and withdrawals. The multi-asset support simplifies the user experience and broadens accessibility. Integration with Drift's SDK enables direct interaction with trading functions, immediate access to market data, and utilization of sophisticated order types for optimal hedge execution.

Data Processing

Real-time Pipeline

At the core of the hJLP strategy lies a sophisticated real-time data pipeline that continuously monitors the Jupiter Liquidity Pool. This system tracks JLP Pool composition across multiple assets including SOL, ETH, BTC, USDC, and USDT, while simultaneously monitoring perpetual position updates, JLP token supply changes, and aggregating price feeds from multiple sources to ensure reliability.

Delta Calculation

The strategy employs precise mathematical formulas for delta calculations. For each asset in the JLP pool, the asset-specific delta is calculated as:

Copy

Δa = (spotLiquidity a - longPerp a + shortPerp a + undistributedFees) / jlpSupplyThis formula incorporates the value of assets in JLP spot liquidity, total long and short perpetual positions, and undistributed fees waiting in escrow. The total portfolio delta is then computed as the sum of all asset-specific deltas.

Hedging Strategies

Gauntlet has evaluated several hedging strategies, both temporal and bounded, and may employ any combination of the following, balancing risk mitigation with cost efficiency. The temporal strategies include a 5-minute hedge that provides aggressive delta neutrality with full offset every 5 minutes and a maximum slippage parameter of 10 bps. The hourly hedge offers a more balanced approach with lower trading costs, while the daily hedge provides the most cost-effective solution but accepts higher intraday exposure.

The bounded delta strategies present another approach to risk management. The 1% dollar bounds strategy rebalances when the dollar delta exceeds ±1%, providing continuous monitoring and balanced cost-risk management. Asset-specific bounds apply tailored thresholds up to 5%, with independent monitoring per asset. The 20%-10% bounds strategy employs a buffer zone approach with an upper bound of ±20% and a rebalance target of ±10%.

Execution Management

The strategy implements sophisticated execution management techniques to optimize trade execution. Order splitting is determined by dividing the order size by the maximum single order size. TWAP implementation distributes execution time across splits, while liquidity-aware execution ensures optimal trade sizing based on available market liquidity and maximum allowed market impact.

NOTE: Gauntlet does not match orders, size trades, execute, or settle transactions. Those processes are completed by the Drift SDK.

Last updated

Was this helpful?