Get in Touch!

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Welcome to our Morpho VaultBook, where you can learn about our Morpho Vaults, our approach to curation, and the various risk considerations that inform our strategies.

We began curating vaults on Morpho in early 2024. We now curate 30+ vaults across Ethereum, Base, and Polygon, with more to come. Vaults are categorized into three distinct risk levels:

Gauntlet Ecosystem Vaults can also be deployed in partnership with DeFi protocols that wish to integrate Gauntlet Vaults into their product stack. These can be either Prime, Core, or Frontier.

In this VaultBook, you can learn everything you need to know about Gauntlet Vaults. Find detailed information on 40+ Gauntlet-curated vaults across Morpho, Drift, and Symbiotic. Explore strategy details, curation methodologies, incentive and fee structures, and more.

Last Updated: March 29, 2025

Gauntlet is the leading model provider in crypto, building optimization strategies for tokens, protocols, and chains. Leveraging our knowledge base and an expansive track record, we have become the premier curator in DeFi, monitoring and managing risk across custom vault strategies.

Our work equips investors, builders, and token issuers with data-driven strategies to confidently allocate funds onchain by leveraging the most trusted crypto-economic research and analysis. With eight years in the space, we’ve built models safeguarding tens of billions in digital assets across the crypto ecosystem, driving capital efficiency and mitigating risk.

Our core strengths lie in our sophisticated approach to financial modeling, risk management, and research. Our team excels in advanced risk modeling and parameter optimization, delivering risk-optimized performance for our partners. We elevate their strategies and implementations through rigorous stress testing and scenario analysis, coupled with detailed economic security assessments.

Frontier Vaults target the highest risk-optimized yields across Morpho Markets by allocating to potentially higher volatility markets that may face liquidity risks in exchange for the potential of greater supplier returns. These vaults are available for users with higher risk tolerance who wish to have exposure to the highest-yielding digital asset pairs.

Frontier Vaults will continue to adhere to our evaluation and due diligence requirements that apply across all our vault risk categories:

Due diligence: All underlying markets must pass Gauntlet’s due diligence process.

Audits: Certified audits from top industry auditors are required before vault inclusion.

Active curation: Regular risk parameter reviews ensure vaults continually align with existing market conditions.

Ethereum

Ecosystem Vaults target bespoke strategies that can integrate into a partner's product stack. Examples include bespoke earn programs and a tokenized Vault for integration into a DeFi stack.

We work with our partners to implement an optimized Vault strategy through our rigorous due diligence and risk management frameworks.

Follow the links to the Gauntlet App for real-time vault analytics, including historical APY, utilization %, supply, and collateral at risk.

Polygon

Core

Polygon

Core

Polygon

Core

Base

Core

Base

Core

Ethereum

Prime

Ethereum

Prime

Ethereum

Core

Ethereum

Core

Ethereum

Core

Ethereum

Core

Ethereum

Core

Ethereum

Core

Base

Core

Base

Core

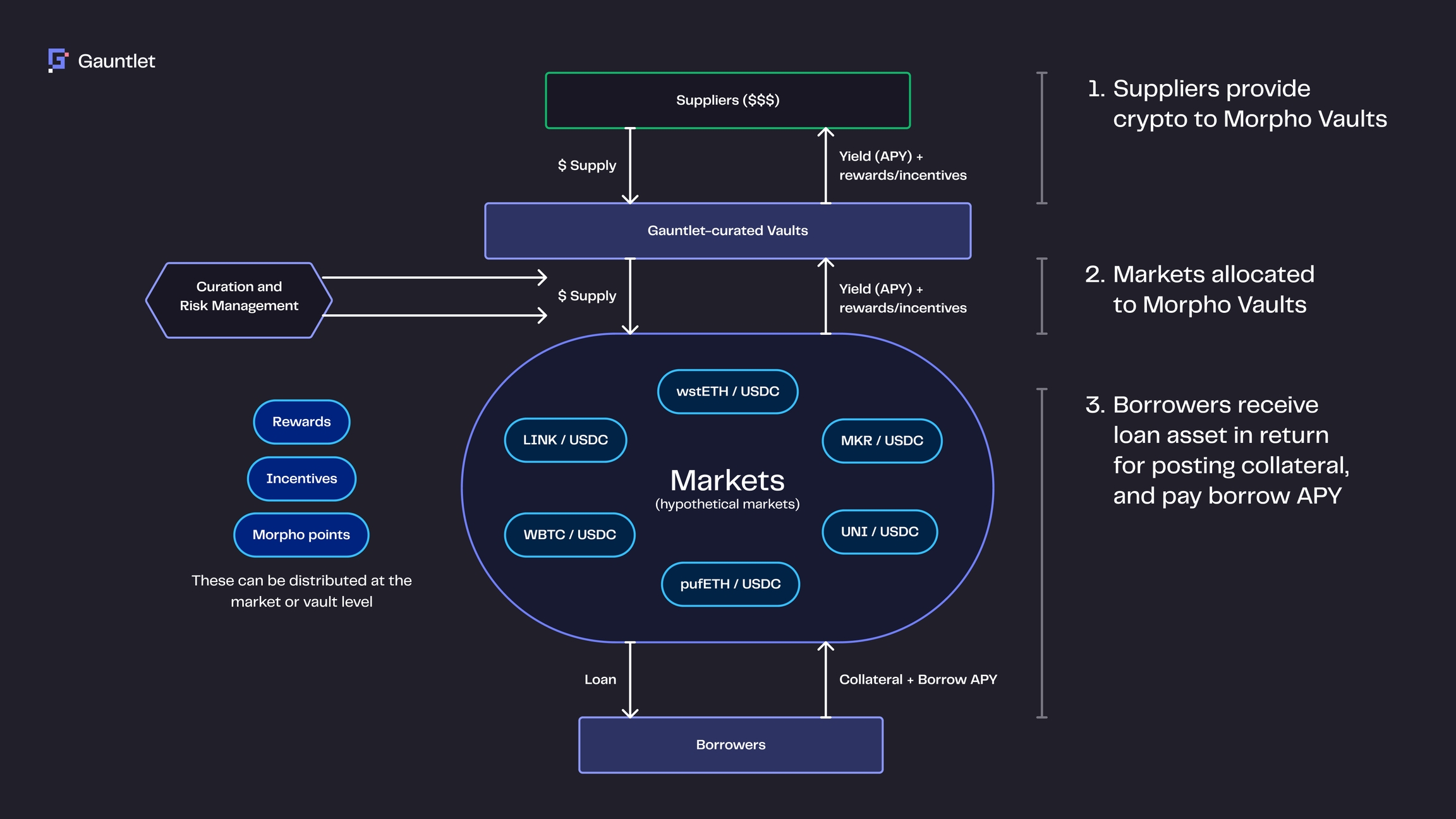

As a vault Curator, we play a vital role in the Morpho ecosystem, acting as the primary intermediary between suppliers and Morpho Markets. We create markets, curate risk, optimize returns, and manage liquidity. Vault Curators can take the following actions within a particular vault:

Allocate user supply between various Morpho markets

Manage supply caps for different markets to manage risk and optimize yield

Set vault fees to earn a proportion of the interest

In line with their non-custodial nature, all supply and withdrawal transactions can only be completed by the user.

The supply asset is the foundation for a vault. To access Gauntlet-curated vaults and the associated risk-adjusted yield, a supplier must add supply to the vault.

Annual percentage yield, APY, is the main economic draw of MetraMorpho vaults. It represents the annualized return suppliers receive as a percentage of the assets supplied to a vault. APY is determined by the markets to which a specific vault allocates its supply, as well as any incentives in those markets. APYs change dynamically based on several parameters, including market utilization and supply allocation.

A vault’s supply APY results from the underlying lending markets to which it allocates.

Suppliers are the primary users of Morpho Vaults. They supply a particular asset into a Vault, which generates risk-adjusted yield based on the vault curator’s market allocations. Selecting an appropriate set of markets to supply loan assets against can be a complex task, requiring a nuanced understanding of risk management, market dynamics, and yield optimization. Gauntlet vaults on Morpho simplify this process, with experienced vault curators like Gauntlet executing strategies on their behalf in a non-custodial manner.

Morpho is a leading lending primitive in DeFi. It provides a trustless lending/borrowing layer (Morpho) combined with an abstracted non-custodial risk and yield vault management layer (Morpho Vaults).

Borrowers deposit collateral to borrow loan assets from Morpho Markets, and suppliers supply loan assets to Morpho Vaults. As Vault Curator, we allocate Vault supply to Morpho Markets, optimizing for risk-adjusted yield based on a Vault strategy. Once created, all Morpho Markets are immutable and cannot be edited, providing a stable and reliable infrastructure layer.

Morpho’s unique structure enables the launch of isolated lending markets, each specifying:

One collateral asset

One loan asset

Liquidation Loan To Value (LLTV)

Interest Rate Model (IRM)

Oracle

We combine extensive risk oversight with sophisticated automatic risk rebalancing and yield optimization strategies to ensure our Vaults are optimally allocated to lending markets in any market condition.

Our methodology incorporates sophisticated models for liquidity, price trajectories, and network congestion based on agent models and simulations that interact with smart contracts. We incorporate dynamic monitoring of broader market liquidity for all collateral assets to ensure that profitable liquidations will continue in severe market conditions.

Our strategies automatically rebalance out of lending pools when necessary (e.g. market instability) with increased risk profiles under the supervision of our experienced on-call risk management team. We include some examples of this in the Resources section.

Gauntlet’s Core Vaults target higher risk-adjusted yield, allocating to a blend of large and lower cap collateralized markets while ensuring exposure to any one asset remains within acceptable bounds. Collateral Selection is based on the following factors:

Active management of vault supply to market supply ratios to ensure availability of withdrawal liquidity.

Sufficient liquidity and slippage to perform healthy liquidations in severe market conditions.

Follow the links to the Gauntlet App for real-time vault analytics, including historical APY, utilization %, supply, and collateral at risk.

Ethereum

Ethereum

Ethereum

Ethereum

Ethereum

Ethereum

Ethereum

Ethereum

Ethereum

Base

Base

Base

Base

Prime Vaults offer conservative, low-risk yields to suppliers. These Vaults allocate supply to maximize risk-adjusted yield while targeting minimal risk of insolvent debt even under extreme market conditions.

Prime Vaults will allocate to markets that meet the following criteria:

A blend of super high liquidity blue chip collateral.

High price correlation between supply and collateral tokens.

Some markets may be considered that do not meet these exacting criteria; however, where this is the case, the supply caps and LLTV rations will be set conservatively.

Follow the links to the Gauntlet App for real-time vault analytics, including historical APY, utilization %, supply, and collateral at risk.

Ethereum

Ethereum

Ethereum

Ethereum

Base

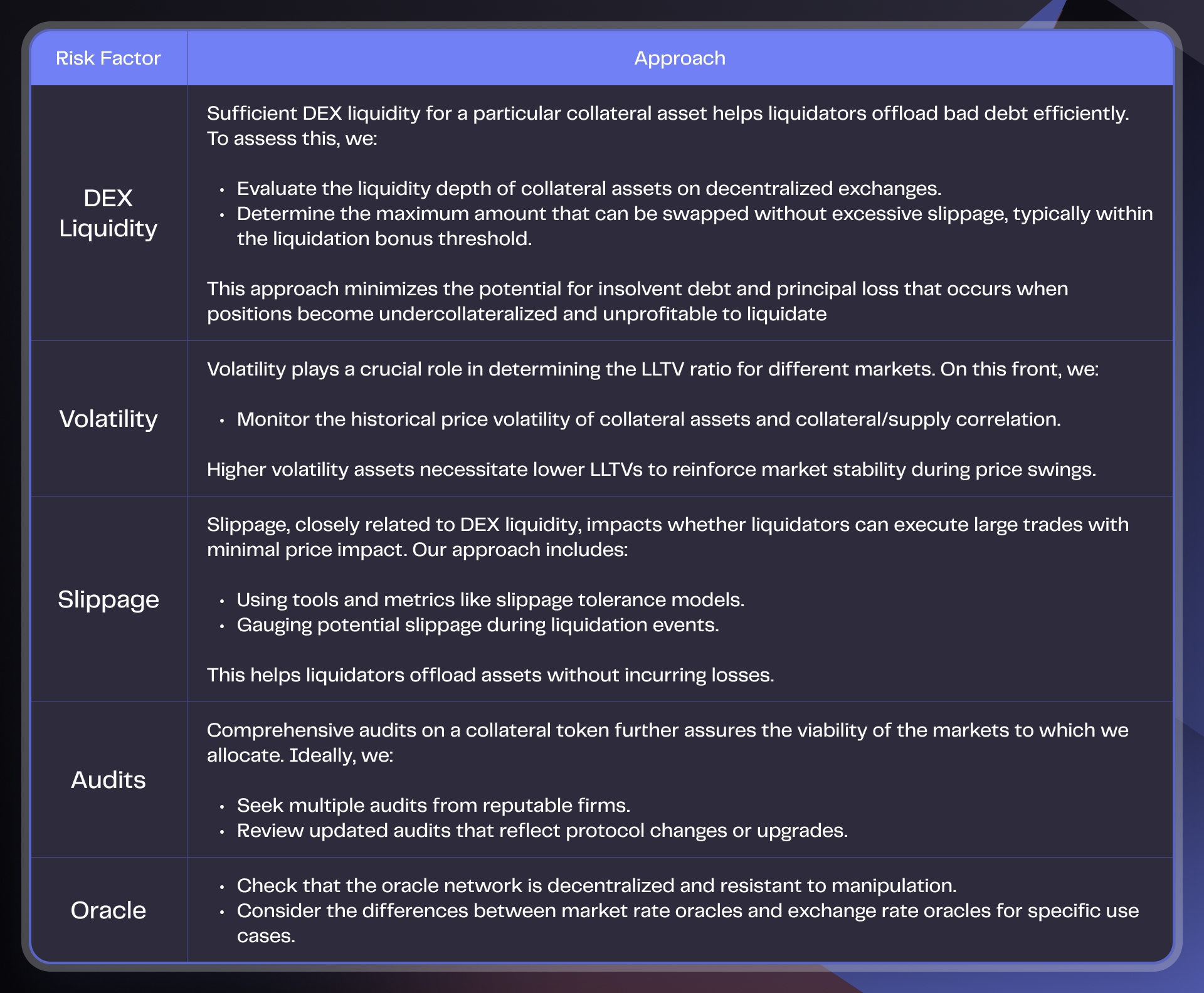

Central to our curation approach is ensuring vaults meet our robust risk guidelines, are attractive to the DeFi community, and remain resilient enough to handle inherent crypto market volatility.

We take stock of various risk factors to inform our vault actions.

In this section, we dive into our approach to vault curation and touch on several topics, including risk exposure, market utilization, asset liquidity, and liquidations.

Our Vaults follow robust risk management guidelines to reinforce resilience against market volatility. This begins with an extensive due diligence process evaluating the liquidity and security of all vaults and markets curated by Gauntlet.

For every new market or collateral asset, our team runs through an extensive playbook that addresses the following four categories:

Liquidity and slippage of the collateral/borrow assets

Existing lending usage

Oracles

Special mechanisms

The primary risk in lending markets stems from insolvent debt, which occurs when risky positions (health factor < 1) aren't liquidated promptly. This typically happens during market stress, when collateral prices fall sharply, and insufficient onchain liquidity makes liquidations unprofitable. Since liquidators operate on profit incentives, they won't act on underwater positions if market conditions make liquidation unprofitable.

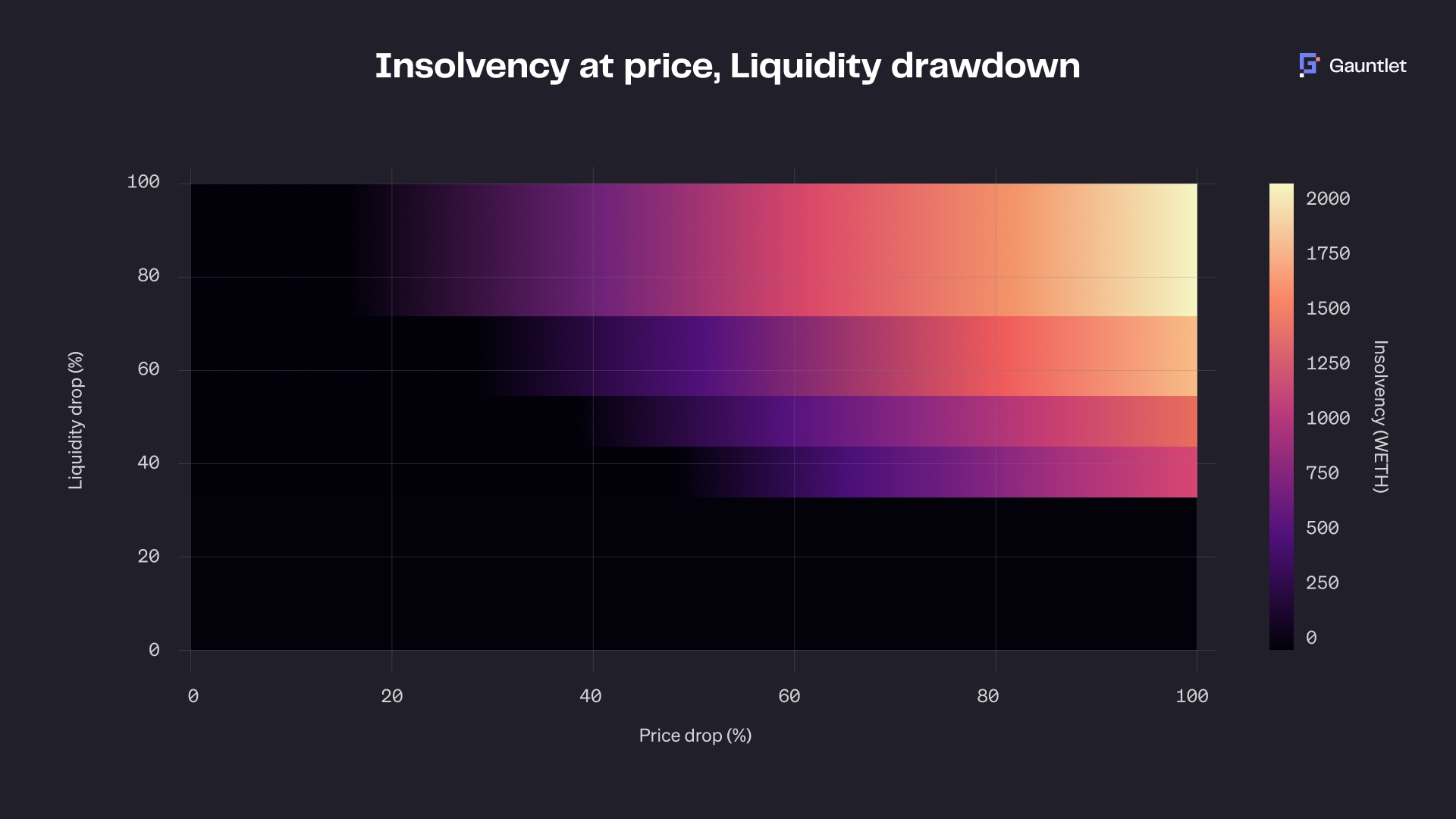

Our market exposure strategy quantifies potential insolvent debt under severe market conditions. We analyze two key metrics:

Price risk: Maximum expected daily price decline

Liquidity risk: Maximum expected daily DEX liquidity reduction

If a market's exposure under an X% drop in the collateral asset price exceeds the liquidity available during a Y% liquidity crunch, we take action to decrease our exposure. We determine X and Y based on historical data, typically setting:

X = the 99th percentile day-over-day price drop

Y = the 99th percentile day-over-day drop in DEX liquidity over the past year

We reduce our position if a market's potential exposure under these stress conditions exceeds available liquidation capacity. This conservative approach applied to Gauntlet Prime and Core Vaults, can maintain near-zero insolvency risk for our vaults, targeting insolvent debt below 10 basis points of total vault TVL even in extreme scenarios.

We continuously simulate the expected number of liquidations and the net volume over adverse price and liquidity scenarios. As described above, when expected insolvencies under the prescribed liquidity and price drawdown conditions exceed our tolerance thresholds, we reduce our vault’s exposure to the at-risk markets as much as possible. This entails reallocating liquidity from markets that are more likely to experience insolvency to a safer market early and often. We will reallocate supply to the idle market if no suitable lending markets exist.

We actively monitor leveraged positions on other prominent DeFi protocols such as Aave, Compound, Spark, and Gearbox. Significant liquidations on these protocols can rapidly deplete the liquidity available for liquidations on Morpho. By monitoring the risk profiles of these protocols, we can anticipate and preemptively adjust our vault’s exposure to markets with bad debt risk.

Markets and Vaults can include incentives in the form of rewards and points added to incentivize supply. Suppliers to our vaults receive the incentives based on their vault positions.

Morpho Vaults allow the Vault owner and/or curator to set a Performance Fee. This fee is calculated as a percentage of the interest earned in the vault. The Performance Fee is charged on Native APY only and not on any yield derived from rewards or points. Our Vault fees range from 0%-20%, and are among the most competitive across Morpho Vaults.

Market allocation is the most impactful action influencing vault composition, with a central role in defining a vault’s risk profile and overall APY.

To inform our allocation strategy, we use fine-tuned Agent-Based Simulations (ABS) that model market scenarios and user interactions within DeFi protocols. Our methodology incorporates detailed models based on sophisticated agent models and simulations that interact with smart contracts.

When allocating to a market, there are three main actions we can take that impact a vault’s risk profile and APY:

Adding a new market: When a new market is added and supply is allocated, the vault APY will change based on the allocation percentage and the supply APY rate.

Adjusting market allocations: To ensure Gauntlet-curated Vaults remain optimized for risk-adjusted yield, our models constantly review market allocations and make necessary adjustments.

Adjusting market caps: The caps we set serve to limit vault exposure to any one market. A cap represents the total amount of supply that can be allocated to a particular market.

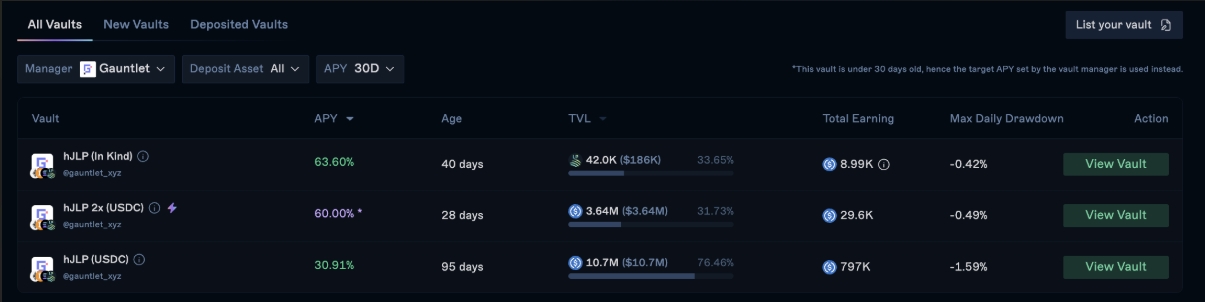

Welcome to our Drift VaultBook, where you can learn about our Drift Vaults, our approach to curation, and the various risk considerations that inform our strategies.

Our existing Drift strategies are outlined below. You can click through to each strategy's page on the left for a deeper dive into how each strategy functions.

|

|

|

|

|

|

|

|

|

|

hJLP Whitepaper

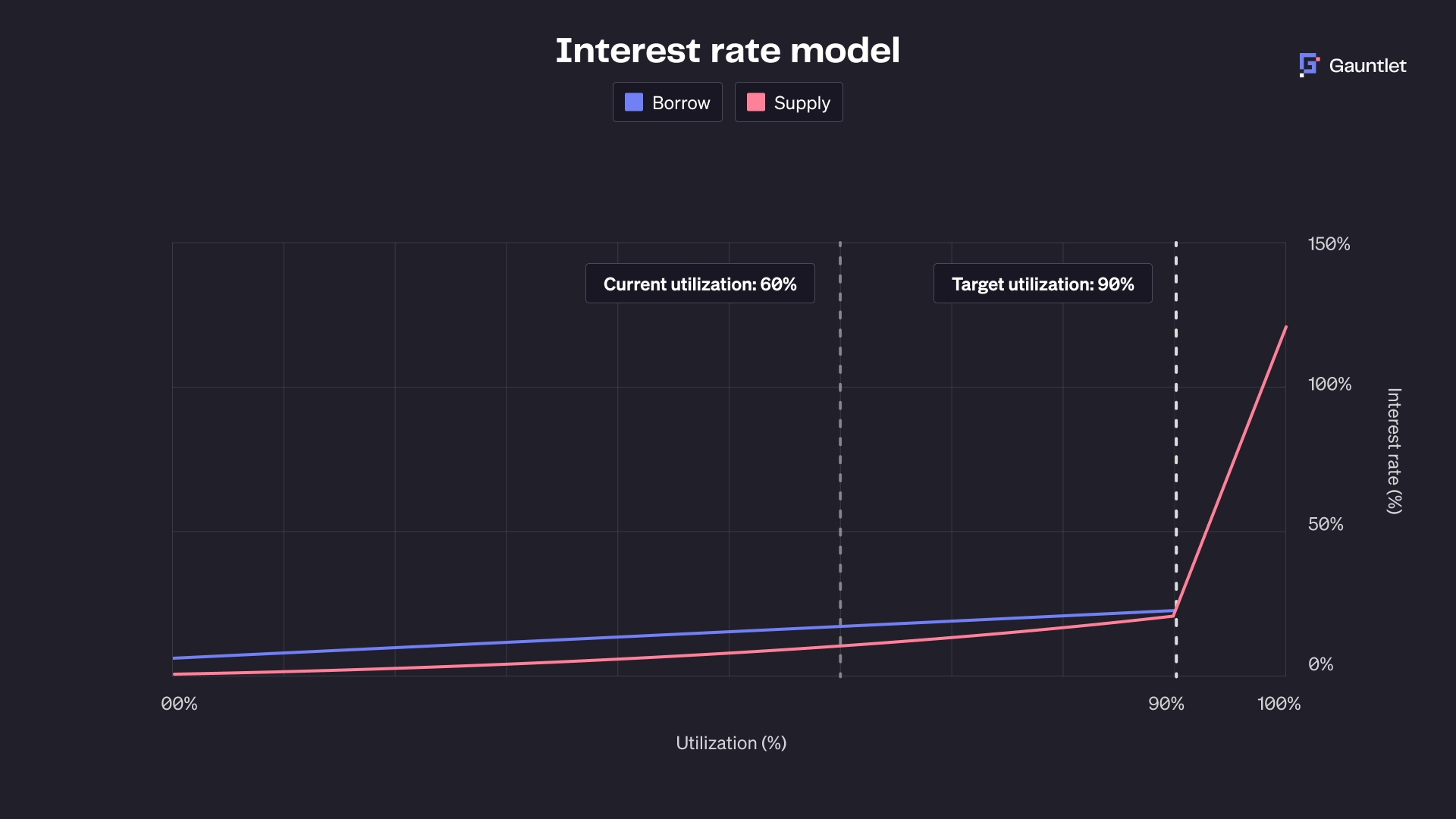

Utilization of any allocated market should not exceed 90% for an extended period of time (>48 hours). Beyond this optimal utilization point, both borrow and supply APYs increase rapidly, which, while beneficial for suppliers in the short term, compels borrowers to unwind positions, reducing long-term yield.

Morpho introduces “idle markets” that allow Gauntlet, as a curator, to ensure that some amount of liquidity is always available for withdrawals.

We constantly monitor overall market liquidity and leverage and rebalance our vault supply allocation in accordance with the solution to the following optimization problem:

Determine a supply allocation that maximizes vault APY subject to the following constraints:

Expected liquidations under specified price and liquidity drawdowns should remain below a predetermined tolerance level based on current market conditions.

Resulting borrow and supply rates competitively must stay within a predetermined tolerance of relevant market rates.

Market utilization must stay between 88-92%.

Liquidity available for immediate withdrawals must be greater than a predetermined withdrawal amount (e.g., 10% of vault deposits available for immediate withdrawal at all times).

Borrow and supply yields should align with market rates to retain suppliers and borrowers:

Stablecoin supply and borrow APYs should not differ from stablecoin rates on other DeFi protocols by more than 1-3%.

WETH staking yields (currently around 4%) should upper bound the WETH borrow rates using wstETH (LRT/LSTs) collateral.

Morpho markets are single collateral/supply markets (as opposed to blended), which increases capital efficiency. Rates can be targeted to be superior for both borrowing (lower) and supply (higher). Ensuring competitive borrow and supply rates helps retain borrowers, facilitating sustainable yield for suppliers in the vault.

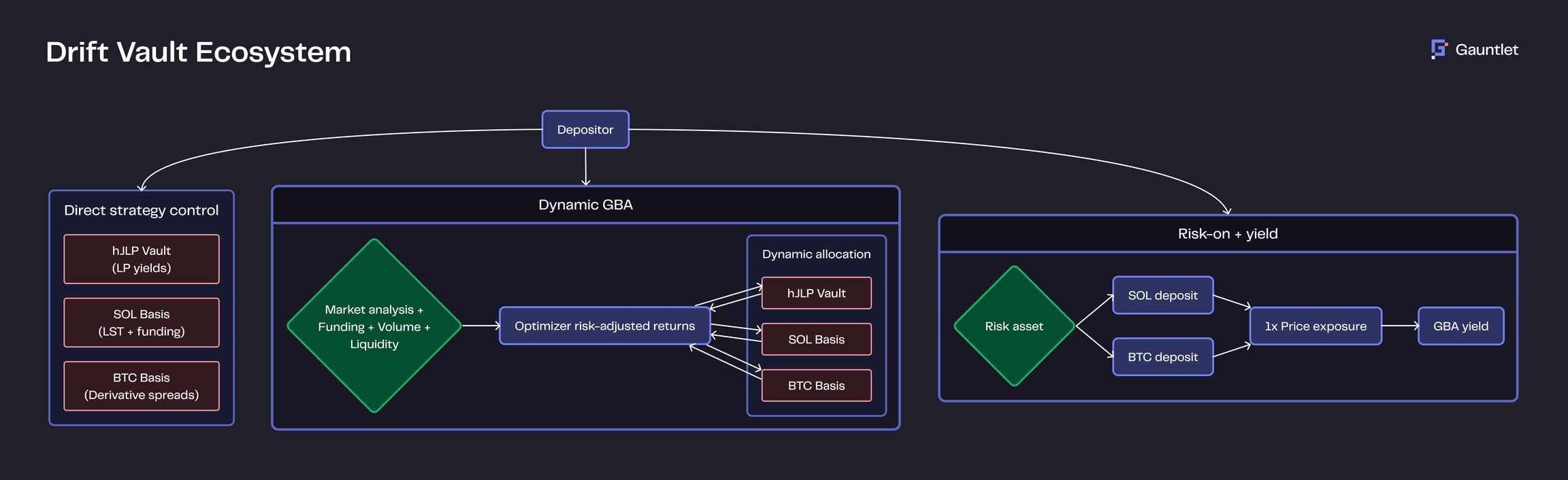

Individual strategy vaults like hJLP form the foundational layer of our vault curation on Drift. These strategies are designed to mitigate risks associated with providing liquidity to Jupiter's perpetual exchange while maintaining attractive returns.

The Beta + GBA Overlay strategies maintain exposure while still capturing basis yields. By supplying SOL or BTC as collateral to borrow stables for GBA deployment, these vaults can earn incremental yield on supplied digital assets.

Together, they create a comprehensive approach to yield generation that adapts to different vault user preferences while maintaining consistent risk management standards.

The Gauntlet Basis Alpha (GBA) strategy implements a portfolio view across all basis trades. Starting with allocations to hJLP, SOL LST, and BTC Basis Trades, it will continuously and autonomously rebalance based on real-time market conditions, considering funding rates, liquidity conditions, trading volumes, and historical performance patterns. This removes the need for active management while maintaining sophisticated optimization. New assets may be added in the future, for current allocations.

A reliable liquidator ecosystem is essential for managing unhealthy borrow positions before market deterioration leads to insolvencies. We actively monitor this ecosystem through ongoing communication with Morpho's liquidation teams.

Liquidators operate through two main strategies.

The flash loan approach starts by borrowing the debt asset from a DEX, repaying the borrower's debt, claiming collateral, and finally swapping collateral back to the debt asset to close the loan.

The inventory approach starts with liquidators holding WETH or stablecoins, swapping to the required debt asset, repaying debt and claiming collateral, and then converting collateral back to their inventory asset for profit.

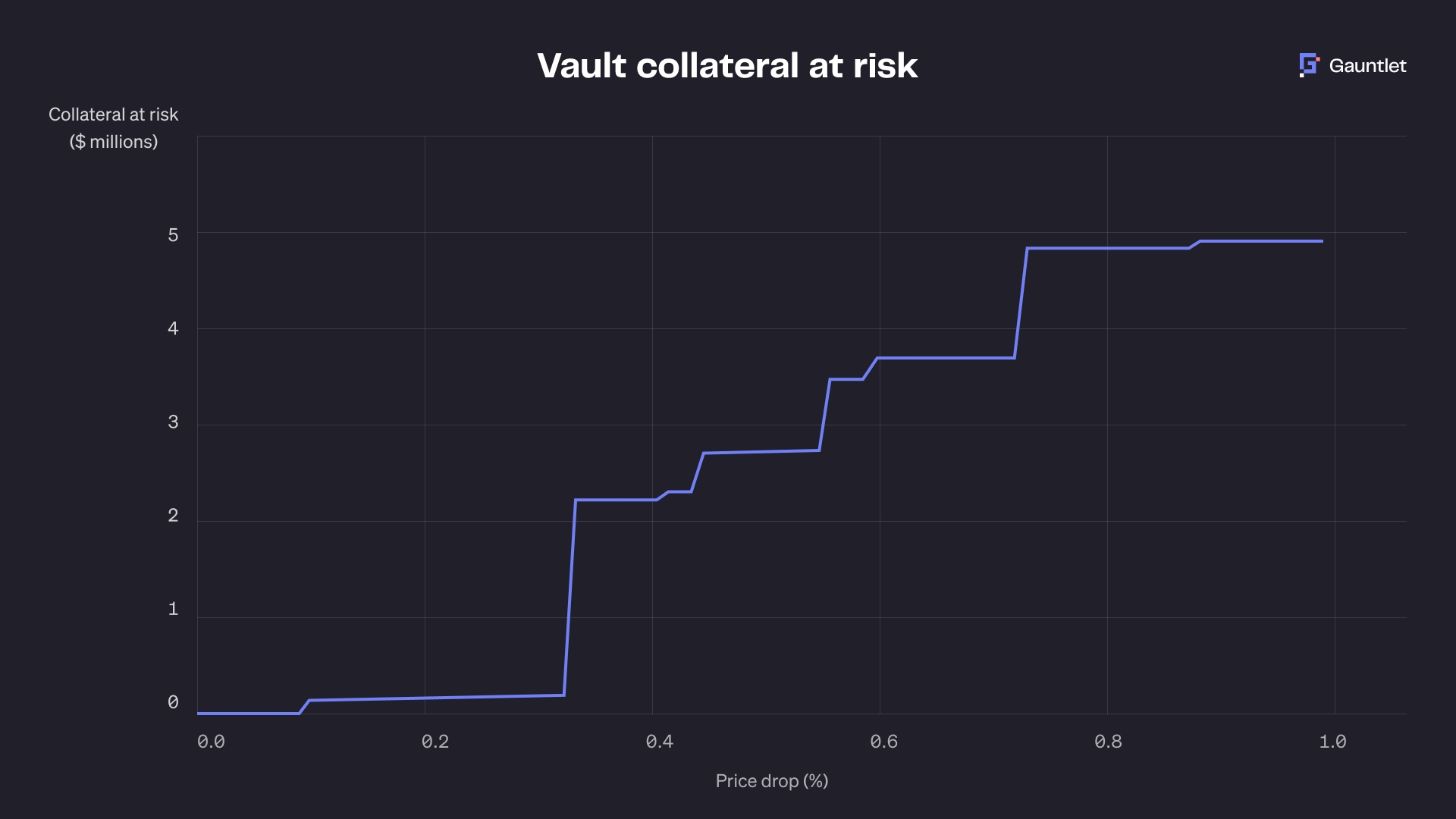

For liquidations to remain profitable and efficient, liquidators need:

Low slippage when selling claimed collateral

Low slippage when purchasing debt assets

Our risk management framework supports this ecosystem by maintaining collateral at risk below key liquidity thresholds and keeping borrowed assets within sustainable liquidation limits. These thresholds are dynamically adjusted based on current liquidity levels with conservative buffers, ensuring market stability even during significant liquidity drawdowns.

Drift Protocol is a strategic partner in Gauntlet's vault strategy implementation. As a decentralized exchange built on the Solana blockchain, Drift provides essential infrastructure for risk-adjusted vault curation.

Our partnership with Drift Protocol brings several crucial advantages to our strategy implementation. As a high-performance perpetual futures trading platform, Drift provides deep liquidity pools that enable the efficient execution of complex trading strategies. Their advanced cross-margining capabilities and transparent on-chain order book system create an ideal foundation for sophisticated trading operations. Furthermore, Drift's robust SDK enables seamless integration with Gauntlet's systems, facilitating smooth strategy execution.

This integration delivers significant benefits to Gauntlet's vault curation. The platform enables efficient position management across multiple assets while reducing counterparty risk through its decentralized execution model. Through Drift's cross-margining capabilities, Gauntlet achieves optimized capital utilization, enhancing the overall efficiency of our strategies. The partnership also provides access to real-time market data, enabling precise strategy execution and risk management.

Vaults

User Interface

1. Accessing Gauntlet Vaults

Protip: filter on 'Gauntlet' as manager to only see vaults curated by Gauntlet

• Select a vault by clicking “View Vault” for details on performance, capacity, and strategy.

2. Depositing Funds

• On the vault’s page, enter the amount you wish to deposit.

• Click “Confirm Deposit,” then approve the transaction in your connected wallet. Once confirmed, your share balance will be updated.

• Deposited funds typically have a redemption lock period (e.g., 3 days) before withdrawal is possible.

Note: because of slippage incurred while entering the strategy, your vault will initially show a negative return immediately following deposit; this is expected.

3. Tracking Performance

• Vault Performance Tab: shows APY (7D/30D/90D), TVL, and metrics like Max Daily Drawdown. Track total earnings and ROI in real-time.

• Your Performance Tab: displays Current Balance, Total Earnings (All-Time), and ROI, along with a chart showing earnings, fees, and high-water marks over time.

• Overview Tab: Summarizes the vault’s strategy, risk profile, and relevant disclosures.

4. Withdrawing Funds

• Click “Withdraw” on the vault’s page and specify the amount (up to your vault balance).

• Withdrawals enter a redemption queue (e.g., 3 days). After this period, finalize the withdrawal to receive funds in your wallet. Any unclaimed amounts will be held in USDC.

• Note that share value changes (due to negative PnL or JLP premium) as well as performance fees collected may cause the final withdrawal amount to be lower than the initial request. Funds in the queue will not accrue further profits.

5. Managing Your Vault Position

• Deposit More: You can add more funds anytime, subject to the vault’s capacity. Note that because the vault collects performance fees whenever a user interacts with the vault, new deposits may trigger a fee if the current vault balance is above the high watermark.

• Compound Earnings: Gains are typically reinvested automatically.

• Monitor Regularly: Check performance, funding rates, and protocol updates to ensure the strategy aligns with your risk tolerance.

• Navigate to the vaults page (), where you’ll see a list of vaults showing APY, Age, TVL, and more.

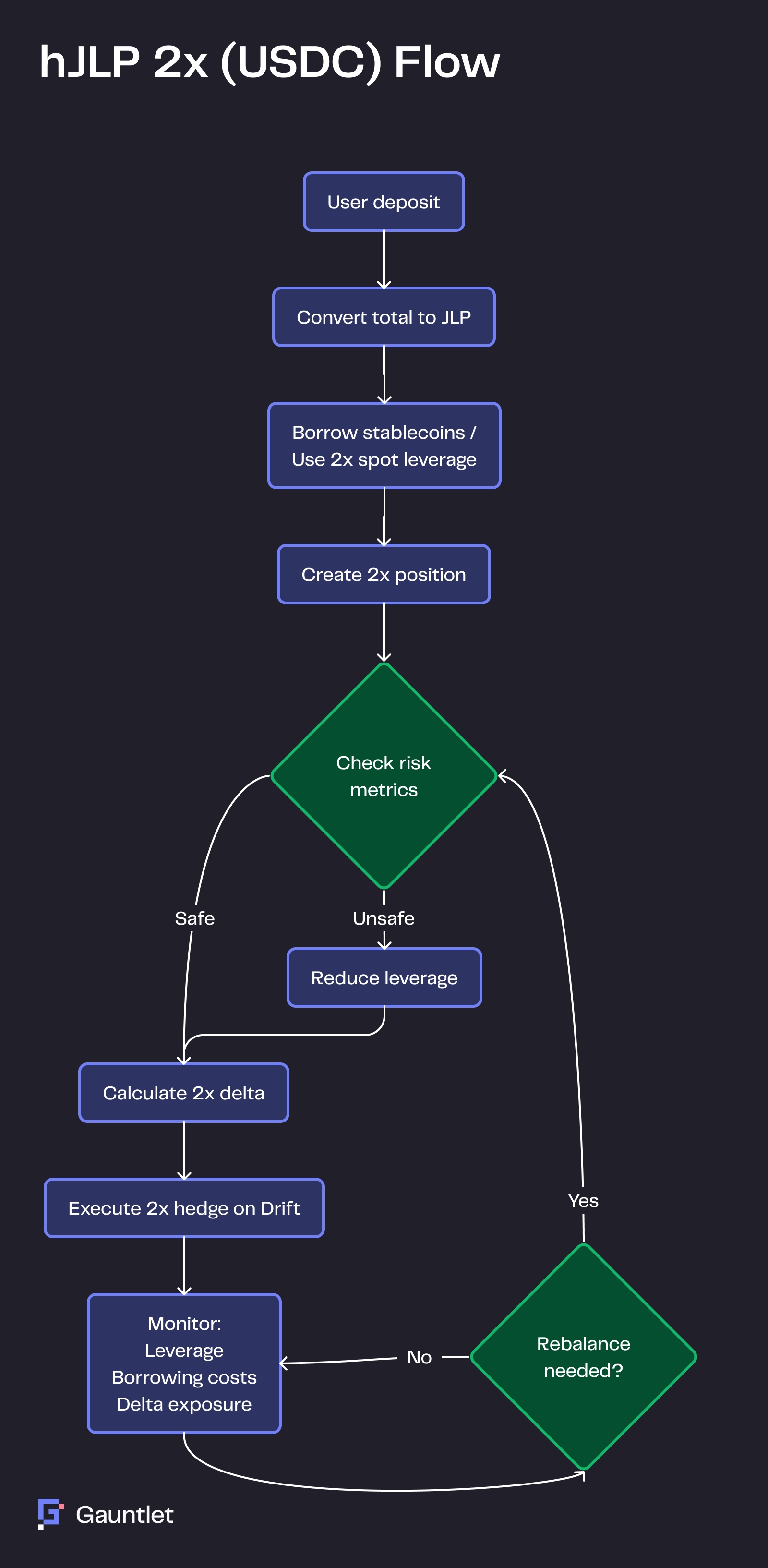

Hedged JLP 2x is a strategy that provides double exposure to JLP yields while maintaining delta neutrality through strategic short positions on Drift Protocol. The strategy targets up to 2x leverage to amplify JLP yields, borrowing stablecoins on Drift's lending market (also called spot margin) to achieve this enhanced exposure. Through sophisticated position management and continuous monitoring, the strategy aims to maximize returns while carefully managing the associated risks of leveraged positions.

The strategy achieves 2x exposure through a carefully balanced combination of techniques. When users deposit funds, the strategy leverages these deposits to create a 2x position in the JLP pool. The leveraged position is then delta-hedged through corresponding short positions in the underlying assets (SOL, ETH, BTC) on Drift Protocol. This process involves taking user supply in USDC, borrowing additional stablecoins to double the position size, converting the total capital into JLP tokens, and establishing corresponding hedge positions on Drift.

The borrowed stablecoins necessary for leverage incur ongoing interest charges that impact the strategy's net returns. These costs are actively monitored and factored into position management decisions, with the strategy continuously optimizing between leverage levels and borrowing costs to maintain optimal performance.

The maintenance of delta-neutral positioning forms a crucial component of the strategy's risk management approach. The total hedge size is calculated as the product of asset exposure and the leverage factor, with the strategy targeting a delta of zero within acceptable deviation bounds (varying between 1 and 2%). Position rebalancing occurs through a system that considers multiple factors, including delta exposure thresholds, regular time-based intervals, and market volatility events.

The strategy employs comprehensive risk management systems that continuously monitor multiple aspects of position health. These systems track leverage ratios against safety thresholds, assess borrowing costs and their impact on returns, monitor delta exposure across all assets, and evaluate liquidation risk parameters. The availability of sufficient liquidity for hedging operations is constantly evaluated to ensure smooth strategy execution.

Liquidation prevention represents a critical aspect of risk management. The strategy implements a multi-layered approach to protection, combining conservative leverage limits with automated deleveraging triggers.

The doubled leverage integral to the strategy amplifies both potential returns and losses. Market risks manifest primarily through price volatility in underlying assets, which can trigger larger position swings due to the leverage employed. While delta hedging helps mitigate directional exposure, extreme market movements can still impact strategy performance through increased rebalancing costs, high borrow interest, and potential liquidation scenarios.

From a technical perspective, the strategy faces smart contract risks despite thorough third-party audits. The reliance on multiple protocols (Jupiter, Drift) compounds smart contract risk from these dependencies. Position management confronts several operational challenges, including data feed reliability for accurate hedging, execution latency during high volatility periods, liquidity constraints on Drift affecting hedge placement, and interest rate fluctuations impacting borrowing costs.

The strategy operates through non-custodial smart contracts that maintain user custody of funds through private key control. While contract upgrades and parameter changes remain possible, the system's core architecture ensures users retain ultimate control over their assets. Position management occurs through an automated system that handles real-time monitoring of leverage and exposure, rebalancing of hedge positions, adjustment of borrowing positions, and optimization of gas costs.

Visit the .

Your crypto, with extra yield on top. Gauntlet Plus vaults overlay delta neutral yields from Gauntlet Basis Alpha on top of your favorite crypto assets. This type of strategy is known as Beta/Alpha Overlays.

The Gauntlet Plus strategies represent a directional approach to portfolio construction. Designed specifically for the current market environment, these strategies solve a fundamental problem: how to generate sophisticated yields without giving up market exposure.

Available in a number of crypto denominations (see ), these strategies maintain the original asset exposure while using it as collateral to borrow stables, which is then deployed into the strategy. This creates two parallel return streams - possible market price appreciation (or depreciation) and delta-neutral basis yields - without requiring investors to exit their core positions.

Visit the .

The Gauntlet Basis Alpha (GBA) strategy represents a step forward in portfolio management within the strategies offered. Rather than focusing on a single basis trade, GBA deploys capital across multiple delta-neutral strategies including hJLP, SOL basis, and BTC basis, among others. See the on Drift for the latest allocations. The strategy continuously rebalances based on real-time market conditions, considering funding rates, liquidity conditions, trading volumes, and historical performance patterns. Additional assets may be added to the scope of basis trades in the future (subscribe to our to be notified). This approach can scale positions up to 2x leverage when conditions allow but always maintains its primary focus on optimizing risk-adjusted returns rather than chasing maximum yield.

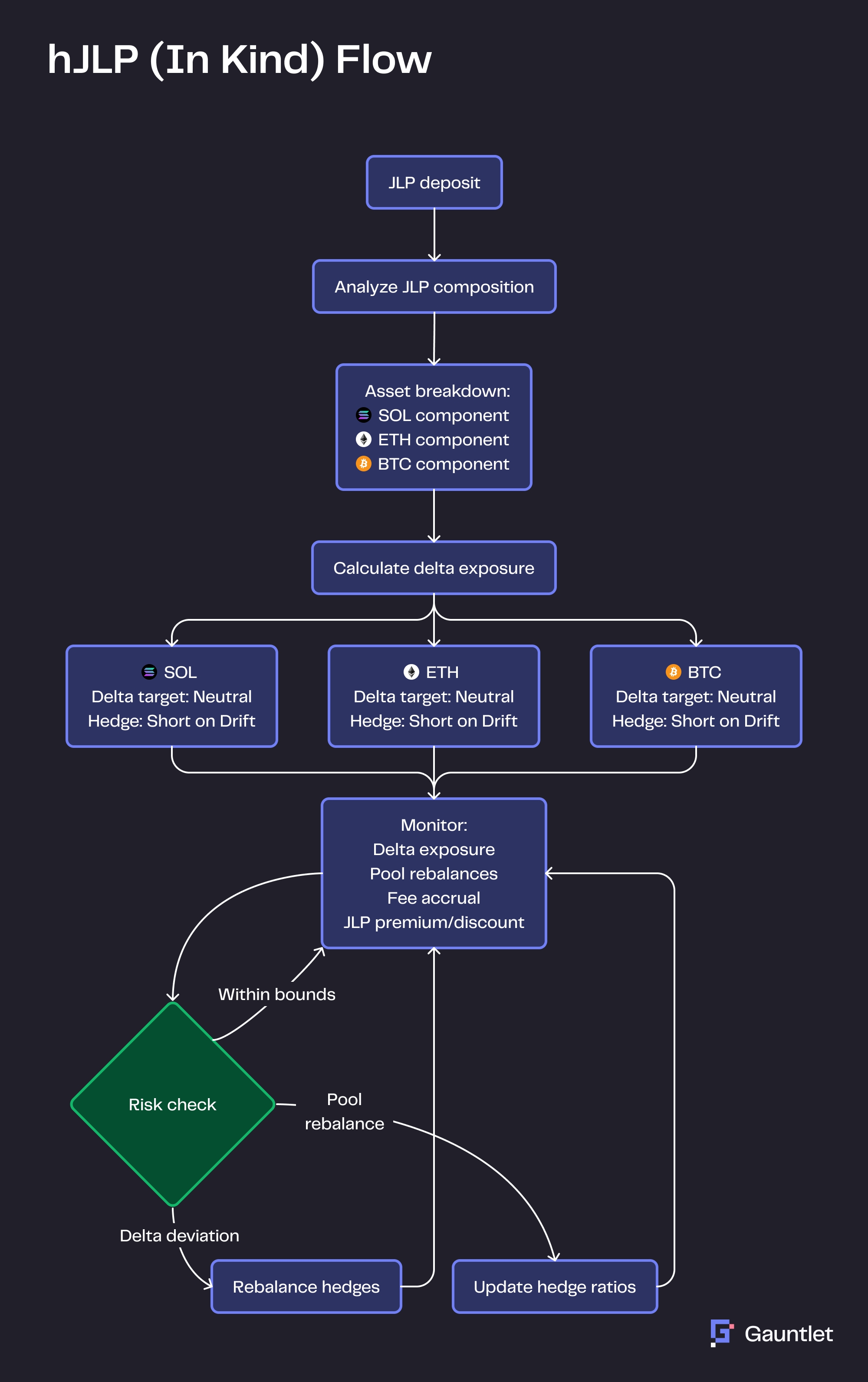

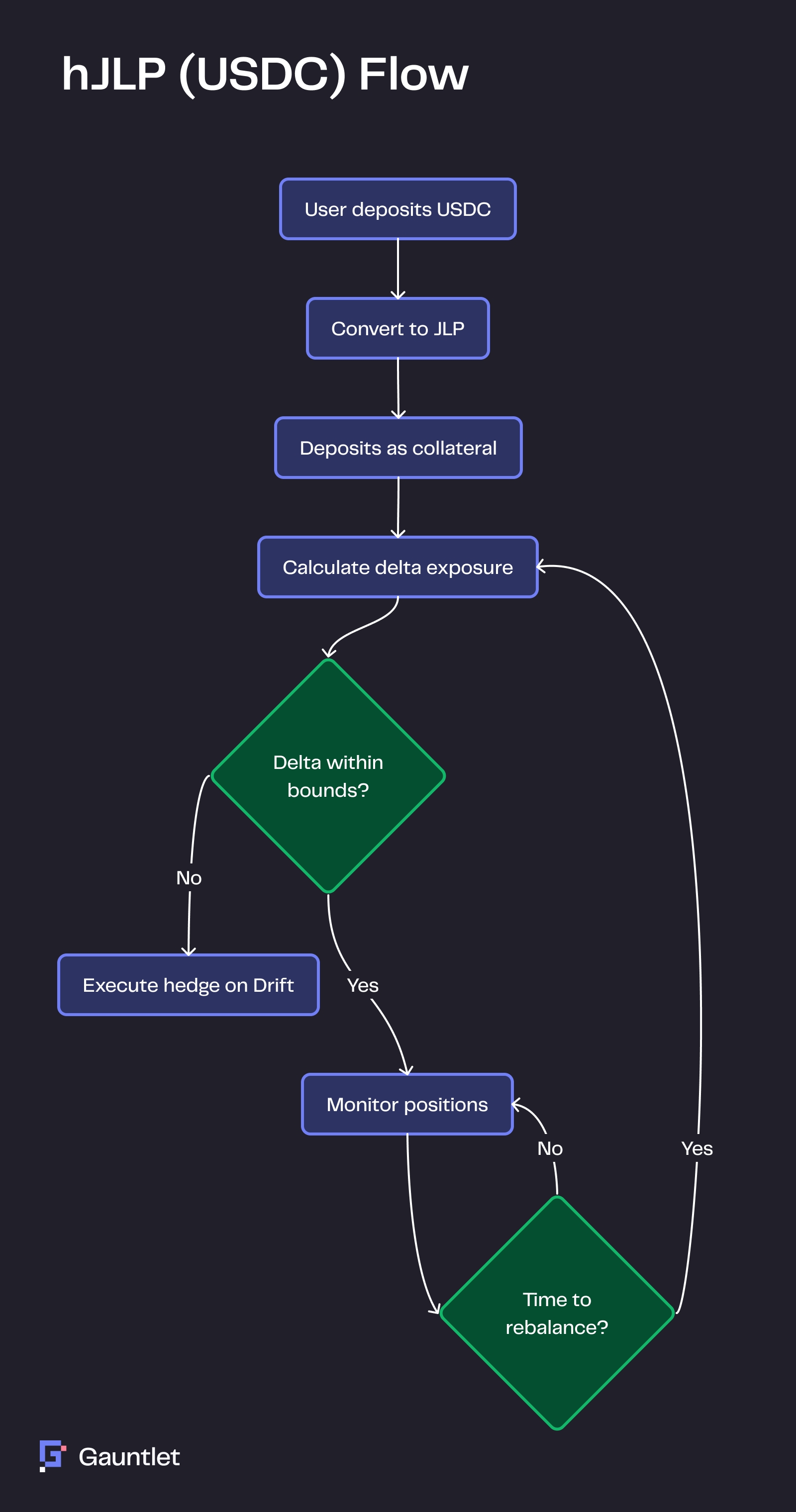

The In Kind JLP vault enables direct JLP token deposits while implementing hedging to protect against price movements of the JLP basket assets. Users maintain exposure to Jupiter's liquidity provision fees while neutralizing underlying price risks without needing to convert their tokens to USDC first.

Similar to the 1x hJLP (USDC) vault, this strategy creates matching short positions on Drift protocol to offset price exposure. Revenue comes from two main sources:

Jupiter trading fees proportional to JLP share

Funding rate yield from Drift short positions

This vault seeks to preserve the USD value of the principal, deposited in JLP tokens, while accruing fee revenue from providing liquidity to the Jupiter Perpetuals market. JLP holders do not need to trade out of their asset into USDC to use this vault, thereby saving on slippage and transaction costs.

Users receive JLP tokens on withdrawal. Because the strategy hedges price risk in USD terms, the token quantity may vary from deposit.

Why use Drift for hedging?

Several key reasons:

Avoid reflexive risk from hedging JLP on Jupiter itself

Better funding rates compared to Jupiter's fixed borrow rate

Ready-made vault infrastructure and SDK

Sufficient liquidity for current strategy size

Cross-margin capabilities are more capital efficient

For vaults that charge performance fees:

Fees are taken on profits, not total value

Charged by account during supply and withdrawals or quarterly across all accounts

High water mark prevents double-charging

Fees remain invested until withdrawal

For vaults that charge management fees:

Fees are taken on the total value of the account, pro rated for the time the position is held in the vault

Charged on all accounts anytime anyone supplies, withdraws or quarterly (3 business days prior to quarter end)

Fees remain invested until withdrawal

The high water mark is used to calculate the profits of your position upon which performance fees are charged. Fees on USDC denominated vaults are charged anytime an address either withdraws or supplies, as well as monthly 3 business days before the end of the month. Since users may not withdraw their full position in a given month, the high water mark tracks the highest amount of profits upon which fees have been charged, so that a user is not double charged for gains in multiple months.

The high water mark is calculated as gross of fees.

Note: Although the current balance on the Drift FE is quoted net of fees, that is only hypothetical, denoting what you would be charged if you were to withdraw your entire account today. If market valuations change and your account balance decreases, the hypothetical fees owed also decrease with it.

This is because returns are snapshotted daily, but TVL varies intraday as new users join or leave the vault.

As an example, suppose you were the sole user with $1M. In the morning, hJLP experiences a 1% loss, so your position is 990K. At noon, someone else supplies 990K, so that you now have a 50% stake in the vault. In the afternoon, hJLP experiences a 1% gain, so the vault value is 1,999,800, of which your stake is worth 999,900. At the end of the day, you lost $100, but the vault gained (1,999,800 - 1,000,000 - 990,000 = $9800). As you can see, the divergence between the daily snapshotted vault performance and personal performance is just caused by the randomness of returns sequencing and the timing of supplies and withdrawals to the vault.

Different scenarios have different impacts:

Jupiter issues affect JLP value and trading

Drift issues affect hedge positions

Smart contract risks exist for both. We maintain contingency plans for various scenarios, but users should understand platform risks.

How does the SOL Basis strategy work?

The SOL Basis strategy combines two yield sources in a single vault. It uses SOL LST (Liquid Staking Token) as the spot asset to earn:

Staking rewards from the LST

Perpetual funding rates from derivatives The strategy can use up to 2x leverage when market conditions create favorable spreads between borrowing costs and funding rates.

Why use dSOL as the spot asset?

We chose dSOL due to:

Deep liquidity for efficient trading

Reliable staking rewards

Strong market integration However, the strategy can optimize across different SOL LSTs based on market conditions and opportunities.

How does the BTC Basis strategy differ?

The BTC Basis strategy:

Uses cbBTC as the spot asset

Focuses purely on perpetual funding rates

Doesn't include staking yield

Can employ up to 2x leverage when spreads are attractive

Dynamically scales positions based on vault balance and market conditions

What is GBA?

GBA is a portfolio strategy that deploys capital across multiple delta-neutral strategies:

hJLP allocations

SOL basis trades

BTC basis trades

Other basis trades

The strategy automatically balances these positions based on market conditions.

How does GBA manage allocations?

Initially, the strategy will employ funds based on static/manual weights. In the future iterations, the strategy will consider:

Current funding rates across markets

Available liquidity

Trading volumes

Historical performance patterns

Risk metrics and limits

Why choose GBA over individual strategies?

GBA offers:

Diversified yield sources

Optimized risk-adjusted returns

Less hands-on management needed

What are Overlay strategies?

These strategies let you earn yield while maintaining market exposure:

Supply your SOL or BTC

Use it as collateral to borrow USDC

Deploy borrowed USDC into GBA This creates dual return streams: possible price appreciation plus basis yields.

How do Overlay strategies manage risk?

Risk management includes:

Careful collateral ratio monitoring

Dynamic leverage adjustment

Liquidation risk management

Market exposure tracking

Continuous position rebalancing

What's the difference between SOL and BTC Overlay?

Both strategies follow the same principle but differ in:

Underlying asset characteristics

Collateral ratios

Borrowing costs

Market liquidity considerations

Risk parameters

What is the USDC vault strategy?

The USDC vault lets you supply USDC to get delta-neutral exposure to Jupiter's liquidity provision. When you supply, the vault converts your USDC to JLP, creating matching hedge positions on Drift. You earn returns from Jupiter's trading fees and Drift's funding rates while being protected against price movements in the underlying assets.

How are returns generated?

Returns come from multiple sources:

Jupiter trading fees (from perpetual market activity)

Funding rates from Drift hedge positions

Liquidation fees when traders get liquidated

Borrow fees from traders

The strategy doesn't rely on asset price appreciation, making it effective in both up and down markets.

What happens during withdrawals?

The vault has a 3-day withdrawal period. During this time:

Your position is marked for withdrawal and will no longer accrue yield

The strategy gradually unwinds positions using TWAP

If the share value declines during this period, the withdrawal amount will be reduced proportionately

If liquidity is low, we may borrow USDC against JLP

You receive USDC back, minus any applicable fees

Why do I see initial negative performance?

Initial negative performance usually comes from entry costs:

Slippage when converting USDC to JLP

Trading fees for opening hedge positions

JLP premium/discount fluctuations These costs typically recover within 5 days through fee generation.

How does the in-kind vault differ from the USDC vault?

The in-kind vault accepts direct JLP supplies, saving on conversion costs and slippage. This makes it ideal for:

Existing JLP holders wanting price protection

Users who can source JLP efficiently

Those wanting to maintain JLP position while hedging. The vault creates hedge positions but returns JLP rather than USDC on withdrawal.

What risks does the in-kind vault hedge?

The vault hedges:

Price movements in SOL, ETH, and BTC

Delta exposure through continuous rebalancing

Market volatility through position sizing

It doesn't hedge:

Impermanent loss from pool rebalances

JLP premium/discount fluctuations

Smart contract risks

Can I supply when JLP hits its TVL/supply cap?

Yes, the in-kind vault remains open even when JLP reaches its TVL/supply cap. Since you're supplying JLP directly, you avoid the premium that typically appears when the cap is hit. This is a key advantage over the USDC vault, which might restrict supply during cap periods.

How does withdrawal work for in-kind?

You receive JLP tokens when withdrawing. The number of tokens might differ from your supply due to:

Hedge position PnL

Accumulated fees and returns

JLP price changes relative to underlying assets. However, the USD value should remain relatively stable due to hedging.

How does the 2x strategy work?

The 2x strategy amplifies returns by:

Accepting user supply

Borrowing additional funds to double exposure

Converting total capital to JLP

Creating proportionally larger hedges. This provides double exposure to JLP yields while maintaining delta neutrality.

What are the additional risks of 2x?

Beyond standard vault risks, 2x strategy faces:

Higher liquidation risk during volatility

Borrowing costs that impact returns

Larger impact from JLP premium changes

More sensitive to market liquidity

How do returns compare to regular JLP?

The 2x strategy can outperform unhedged JLP in:

Down markets (hedges provide protection)

High funding rate environments

Periods when leveraged yield exceeds price moves However, borrowing costs and larger hedging expenses can reduce returns.

What happens if markets become very volatile?

The strategy has multiple approaches for mitigating high volatility:

Automated deleveraging triggers

Dynamic collateral management

Emergency shutdown mechanisms

Increased rebalancing frequency

When using Gauntlet’s Vault strategies, vault users should understand several key risk categories:

Price volatility in underlying assets and fluctuations in funding rates can significantly affect returns. Liquidity may dry up during high-volatility periods, and correlations between assets can break under stress. These factors require careful position sizing and robust risk management.

Execution slippage, especially in less liquid markets or during volatility spikes, can erode profits. Transaction timing is often critical, and even rare system downtime must be considered. Integrating multiple protocols demands thorough testing and meticulous attention to detail.

Upgrades and parameter changes can introduce new vulnerabilities. Despite third-party audits, users remain exposed to smart contract failures, market volatility, and potential socialized losses.

Some strategies use leverage, which amplifies both gains and losses. Position management errors, hedging delays due to limited liquidity, fluctuating borrowing costs, and liquidation during extreme market conditions are key concerns. The hedged vault may also face data or execution errors, inadequate liquidity on Drift for full delta hedging, and liquidation risk on hedge positions during periods of high volatility.

Last Updated: December 11, 2024 Please read all of this.

By using any Gauntlet Vault, you acknowledge and agree that:

Gauntlet's (also “we” and “us”) provision of vault services is not investment, tax, legal, or technological advice. None of Gauntlet's vaults are depository or custodial products, and none of your digital assets are guaranteed by Gauntlet or any other person. We are not a fiduciary for any vault user, nor will we act as a broker, custodian, investment adviser, or asset manager through our provision of the vault services. Vault users will always deploy their assets at their own risk, with full understanding that (i) their digital assets may lose some or all of their market value;(ii) their digital asset positions may be liquidated partially or entirely as a result of parameters that they cannot control or change; (iii) that their digital assets may be compromised or stolen by malicious software attacks; and that (iv) their only recourse to prevent such risks after deploying to a vault is to fully withdraw during the applicable time lock period, which may be as few as twenty-four (24) hours' prior notice.

Any performance fees paid to Gauntlet from a Drift vault cannot be reclaimed after the vault pays them. Gauntlet's only contractual obligations arising under this protocol are those that we have to Drift. We have no contractual obligation to you, any vault user, or any other third-party arising from providing vault services.

Further, understand that some vault strategies may involve the use of leverage. The leveraged nature of such strategies can produce substantial volatility and even significant losses if market prices move in an unfavorable direction. You participate in such strategies at your own risk, and neither Gauntlet nor Drift can offer any guarantees against risk of loss. Only highly sophisticated and risk-tolerant vault users should participate in such strategies.

While we exert our best efforts to select strategies and markets that we think will optimize vault performance; we do not guarantee the accuracy or reliability of our modeling and analysis, and in no event does our modeling and analysis reliably predict or guarantee expected performance or yield. It further does not provide assurance against risk of loss. Make your own risk-reward decisions based on your own sophisticated market perspectives. Finally, remember that you bear full responsibility for lawful possession, custody, and security of your digital assets when you transact with Drift vaults. In short, we set parameters and identify market strategies. The rest is up to you.

That being said, as a result of using Gauntlet’s Vault; you agree to release Gauntlet, its officers, directors, employees, and affiliates (“Gauntlet Parties”) from any claims or causes of action resulting from your use of the vault; including, but not limited to, any financial losses, data breaches, or inaccuracies in information or reporting used by the vault services. Said more plainly; if you use this vault service, your legal recourse is very limited, and you give up any claims that you may have against any Gauntlet Parties, to the fullest extent possible under applicable law.

Visit the .

.

You further acknowledge and agree that our interests as a separate entity may at times conflict with our interests as a vault service provider. In such cases, we will not be required to give priority to anyone else’s best interests. Your only rights and remedies as a vault user will be those included in .

The hJLP (Hedged Jupiter Liquidity Provider) strategy is designed to mitigate risks associated with providing liquidity to Jupiter's perpetual exchange while maintaining attractive returns. This documentation provides a comprehensive overview of the implementation details, data processing mechanisms, hedging approaches, and execution management systems that power the strategy.

Drift Protocol serves as the primary hedging venue for the hJLP strategy. The protocol maintains deep liquidity pools that enable large hedging transactions with minimal slippage. Its cross-margining capabilities allow for efficient capital utilization across multiple trading pairs, allowing the strategy to deposit JLP in the pool and create perpetual positions in multiple assets using the same collateral (JLP in this case). The transparent nature of the on-chain orderbook significantly reduces counterparty risk and enhances overall strategy security.

The strategy implementation follows a process that begins when users deposit supported assets into the hJLP vault. These assets are automatically converted to JLP tokens through Jupiter's DEX, ensuring all user deposits are in the required token for the hedging strategy. The newly acquired JLP tokens are then deposited into Drift as collateral, enabling the opening of initial hedge positions based on current delta exposure in the JLP pool. The system maintains these positions through dynamic rebalancing, triggered either by predetermined time intervals or when positions deviate from target thresholds.

The strategy leverages Drift's vault infrastructure, which provides battle-tested security for user deposits and efficiently handles large volumes of deposits and withdrawals. The multi-asset support simplifies the user experience and broadens accessibility. Integration with Drift's SDK enables direct interaction with trading functions, immediate access to market data, and utilization of sophisticated order types for optimal hedge execution.

At the core of the hJLP strategy lies a sophisticated real-time data pipeline that continuously monitors the Jupiter Liquidity Pool. This system tracks JLP Pool composition across multiple assets including SOL, ETH, BTC, USDC, and USDT, while simultaneously monitoring perpetual position updates, JLP token supply changes, and aggregating price feeds from multiple sources to ensure reliability.

The strategy employs precise mathematical formulas for delta calculations. For each asset in the JLP pool, the asset-specific delta is calculated as:

Copy

This formula incorporates the value of assets in JLP spot liquidity, total long and short perpetual positions, and undistributed fees waiting in escrow. The total portfolio delta is then computed as the sum of all asset-specific deltas.

Gauntlet has evaluated several hedging strategies, both temporal and bounded, and may employ any combination of the following, balancing risk mitigation with cost efficiency. The temporal strategies include a 5-minute hedge that provides aggressive delta neutrality with full offset every 5 minutes and a maximum slippage parameter of 10 bps. The hourly hedge offers a more balanced approach with lower trading costs, while the daily hedge provides the most cost-effective solution but accepts higher intraday exposure.

The bounded delta strategies present another approach to risk management. The 1% dollar bounds strategy rebalances when the dollar delta exceeds ±1%, providing continuous monitoring and balanced cost-risk management. Asset-specific bounds apply tailored thresholds: 3% for BTC, 4% for ETH, and 8% for SOL, with independent monitoring per asset. The 20%-10% bounds strategy employs a buffer zone approach with an upper bound of ±20% and a rebalance target of ±10%.

The strategy implements sophisticated execution management techniques to optimize trade execution. Order splitting is determined by dividing the order size by the maximum single order size. TWAP implementation distributes execution time across splits, while liquidity-aware execution ensures optimal trade sizing based on available market liquidity and maximum allowed market impact.

NOTE: Gauntlet does not match orders, size trades, execute, or settle transactions. Those processes are completed by the Drift SDK.

Welcome to our Symbiotic VaultBook, where you can learn about our Symbiotic Restaking Vaults, our approach to curation, our operator and network allocation strategy, and explore our catalog of Restaking research and presentations.

Our existing Symbiotic Vaults are outlined below. Each Vault allocates collateral to a set number of operators, which in turn have a set of networks to which they allocate. Click on the links below to explore each vault in detail, including points accumulated.

Note: the Symbiotic App is not accessible in the USA or UK.

Visit the .

Twitter:

Telegram contact:

Email:

Visit to start using our vaults

Public | Slashable

Public | Slashable

Public | Slashable

Public | Slashable

Public | Slashable

Public | Slashable

Public | Slashable

Private | Slashable

Our Symbiotic vault set aims to best take advantage of the Symbiotic points campaign by maximizing the number of network allocations without exposing suppliers to excess slashing risk across all preferred collateral options. To accomplish this, we approach each vault by evaluating three major aspects:

Network allocation

Collateral selection

Operator onboarding

To ensure risk is managed beyond the allocation decision, we have instituted both onchain and off-chain controls to enhance monitoring and slashing response. In this post, we summarize our framework for evaluating each risk vertical and how we incorporate this evaluation into our decision-making.

Our allocation methodology differs based on whether the network employs a slashing mechanism.

Slashable networks tend to offer more attractive yields to stakers, but they also introduce a new risk vector with potential loss of staking collateral. As pioneers in DeFi risk curation, our team employs multiple safeguards to minimize slashing risk on our Restaking Vaults, which include:

Technical Due Diligence: Before allocating to each additional slashable network, the Gauntlet team conducts extensive technical due diligence on the network’s technical documentation, smart contracts, and the core team.

Delegator Hook: All Gauntlet vaults on Symbiotic deploy a built-in safety mechanism called delegator hook. The hook’s primary use is to automatically deallocate from a network in the event of slashing. The hook acts as stop-loss for vault stakers in a catastrophic event (operator offline and/or mass slashing).

Onchain Monitoring and Modeling: Our team will leverage an in-house monitoring system to track onchain events, including rewards issuance and potential validator slashing. This is powered by the our cutting-edge quantitative models and actively informs our optimal allocation decisions on the risk-reward frontier.

Our curation model for slashable networks employs an optimization technique called “minimax.” This approach minimizes the worst-case loss for our vault stakers in the event of mass slashing.

With slashing a recent feature on Symbiotic mainnet, we take an incremental approach to our vault’s initial allocations to slashable networks.

With non-slashable networks, we take a risk-adjusted yield-maximizing approach by allocating the maximum amount of vault collateral (up to each network’s limit) to provide shared security to all non-slashable networks.

For example, a critical criterion in our evaluation is abundant market liquidity. Below are the slippage curves of each collateral’s DEX liquidity, with WETH (the top curve) as the benchmark. The CEX issuers of wBETH (Binance) and cbETH (Coinbase) also maintain deep liquidity of their LSTs.

These collateral assets account for over 70% of existing Symbiotic deposits and unlock opportunities to restake with a variety of networks, therefore maximizing capital efficiency and yield.

Operators serve two primary purposes in our evaluation:

Efficiently running networks without exposure to additional slashing risk, and

Diversifying user risk from unexpected slashing.

We aim to onboard operators with a strong track record of high-quality work across existing restaking ecosystems and L1s. Even with this in mind, slashing risk can not be reduced to zero, and spreading allocations across multiple operators reduces the potential downsides from unexpected slashing.

Since late 2023, we’ve given multiple presentations covering our research and thoughts on the restaking space. At EthCC Brussels in 2024, we hosted Restaking Day, which brought the leading minds in restaking together to discuss various aspects of restaking and shared security approaches.

Collaterals are the source of economic security for Proof-of-Stake (PoS) networks. We select collateral assets that score high health factors according to our .

.

: LRTs are a transformational innovation but present novel manifestations of risk. In this presentation we provide an overview of LRTs and discuss the development of secondary markets and AVS selection.

: Here, we define LRTs and categorize their various dimensions of risk.

: In this presentation, we explore how shared security layers facilitate restake to secure secondary services and assess how supporting multiple marketplaces may reduce risk.

: We need a framework to evaluate restaked collateral. This presentation breaks down the importance of reduced price volatility and steady stake balance in restaking.

Here, we explore steps that AVSs can take to ensure overall network security, including choosing a local rewards budget and rebalancing efficiently.

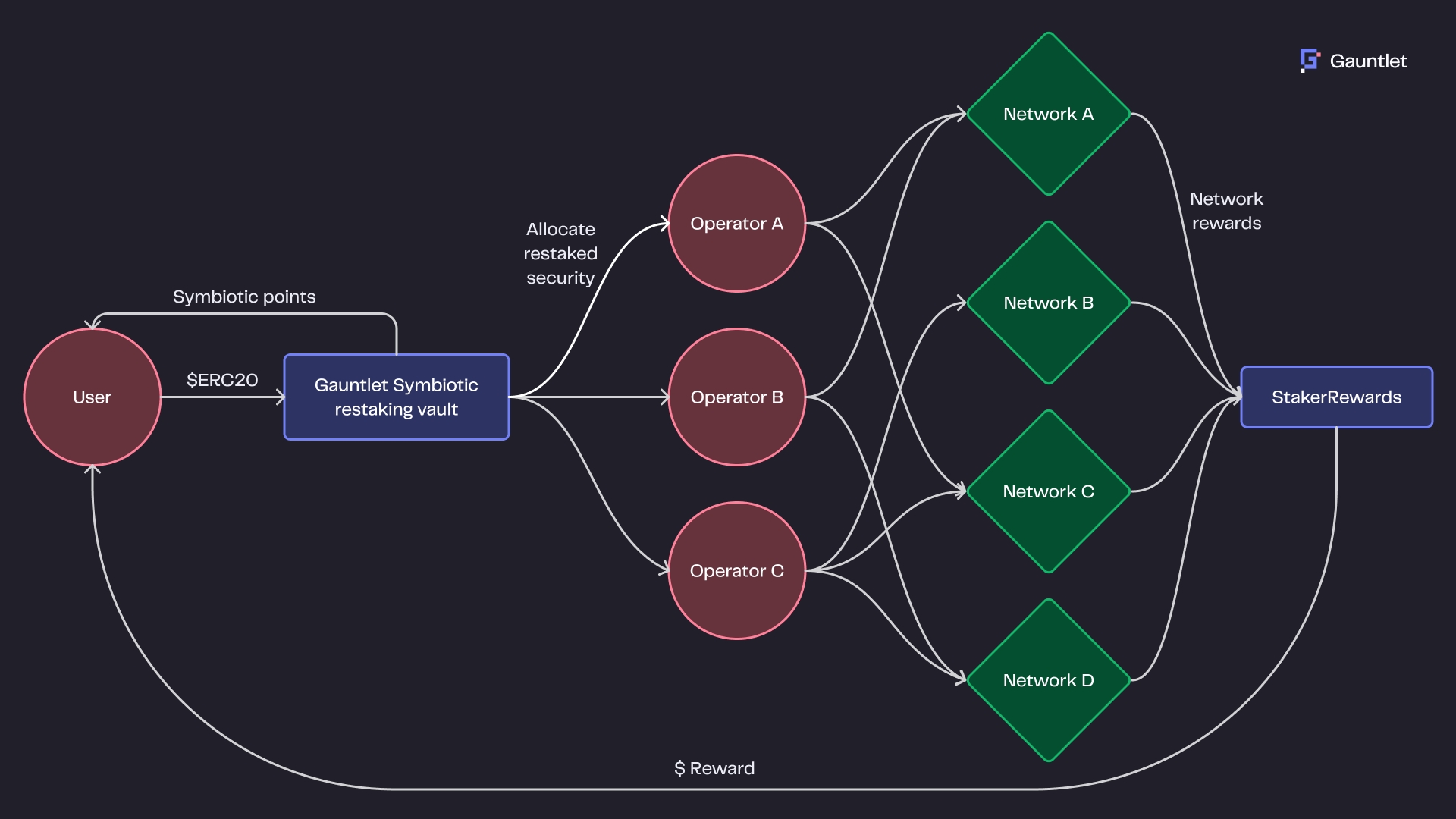

Symbiotic is a restaking ecosystem and shared security protocol designed to create a marketplace for economic security. It enables networks that need security to access it from those with assets to stake, creating an ecosystem where stake can be shared and utilized across multiple networks, a process known as “restaking.”

Vaults serve as a flexible staking layer connecting collateral to networks. Users can deposit their collateral into vaults and benefit from staker and network rewards in the form of risk-adjusted yield. Curators like Gauntlet decide where to allocate that collateral (shared security) and can tailor the risk profile of each vault by determining which networks and operators have access to the collateral.

The main pillars of a Restaking Vault include:

Collateral asset (ERC20) — users supply this asset into the vault

Operators — the vault allocates to a set number of operators

Networks — operators allocate to networks predetermined by the vault curator

Two important actors play a central role in Restaking: operators and networks, where operators can allocate across N networks. Vaults allow curators to manage the economic risks that arise from allocating across various operators. The matrix of allocations across and between operators and networks is the variable that defines the different risk profiles on Symbiotic Restaking Vaults.

Explore all the Gauntlet-curated Restaking Vaults below. Click through to each vault to explore more details on the vaults, including accumulated points, allocated networks and operators, and more.

Public | Slashable

Public | Slashable

Public | Slashable

Public | Slashable

Public | Slashable

Public | Slashable

Public | Slashable

Private | Not Slashable

Below, you can dig into some of our restaking research, including what we believe in the first peer-reviewed research paper about restaking.

: We lay out a mathematical framework for approaching AVS selection, which will ultimately drive better capital efficiency.

: We provide a framework for evaluating LRT market risk, focusing on four main risk attributes: external liquidity, withdrawals, LRT volatility, and DeFi risk.

: We explore various options for EtherFi’s AVS allocation strategy and determine how it may impact its yield accrual.

Our model shows that an adversary with a strictly submodular profit combined with strategic node operators who respond to incentives can avoid large-scale cascading failures.

: We suggest a comprehensive framework for evaluating collateral health in the context of restaking protocols and AVSs. An AVS’s economic security is associated with the price stability of its collateral, since a drop in the collateral’s market value can create profitable attacks to corrupt the AVS.

: We examine the role of stablecoins in restaking. As more (re)staking platforms support staking with arbitrary ERC-20s, stablecoins are becoming a viable means for providing economic security for new networks such as AVSs.

Our restaking team has established Gauntlet as a leading voice in restaking research. We have developed frameworks illuminating AVS allocation strategies, assessed LRT market risk, and analyzed the impact of the growing number of collateral assets.

We've also held numerous talks and presentations about restaking, notably hosting Restaking Day during EthCC Brussels in 2024.

On this page, you can find important Gauntlet policies and disclaimers. Please read them carefully.

November 8, 2023

July 18, 2023

NA

December 11, 2024